Despite rising rates of interest and inflation, 2022 kicked off with a wave of M&A … that became a trickle … and have become a relative dribble by the top of the 12 months.

The ongoing struggle in Ukraine, international provide chain points that simply gained’t stop, sign loss, regulatory scrutiny, advert spending on the decline, tech and media layoffs on the rise – the storm was excellent.

“You’ve acquired all of this uncertainty brewing,” Conor McKenna, a director at LUMA Partners, told AdExchanger in July, “and that creates quite a lot of challenges and places a ton of stress on valuations and dealmaking.”

But it was virtually inevitable that M&A would sluggish in 2022 after the breakneck pace in 2021, when acquisitions had been up 82% year-over-year, in keeping with LUMA.

Yet there’s little doubt that M&A will probably be muted within the 12 months to come back, with fewer large offers getting accomplished. Especially with antitrust antennas up in Washington, DC.

Even so, hope springs eternal, and one firm’s headwind is one other firm’s potential alternative. Privacy considerations, id data-related challenges and concentrating on options, the expansion of retail media and the rise of knowledge clear rooms might all spark curiosity from strategic acquirers.

In the meantime, although, right here’s a radical (however non-exhaustive) refresher on M&A in the course of the 12 months that was.

January

January was so jam-packed with acquisitions, we made a joke about it within the January 20 version of AdExchanger’s day by day information roundup: “Are you sick of listening to about M&A already? TOO BAD! We’ve nonetheless acquired a number of offers being introduced on the common.”

During the primary week of January alone, AppLovin closed its acquisition of MoPub, Integral Ad Science bought a French contextual promoting startup referred to as Context, Smartly.io acquired artistic administration platform Ad-Lib.io, Magnite acquired cryptographic viewers knowledge startup Nth Party, CDP BlueConic sold a majority stake to Vista Equity Partners and The New York Times agreed to buy The Athletic.

And then the bonanza simply saved on bonanza-ing, with a mixture of low-key acquisitions and blockbuster offers.

By the time January drew to a detailed, T-Mobile had dedicated itself to rideshare promoting with its purchase of Octopus Interactive, Take-Two Interactive acquired into cellular gaming with the acquisition of Zynga, Mayfair Equity Partners took a majority stake in outcome-based advertisements platform LoopMe, video content material administration platform QuickFrame was acquired by Ryan Reynolds’s favourite advert tech firm, MNTN – and a bit of firm named Microsoft proposed a (now very contested) $69 billion deal to purchase Activision Blizzard.

And you will have six tries to determine what the New York Times acquired on the final day of January. (Answer: Wordle.)

February

February

The torrid tempo of M&A continued by the winter, though it was a seize bag of offers starting from media and CTV to social activation and audio.

ShowHeroes, a video and contextual concentrating on firm primarily based in Europe, entered the Latin American market with the acquisition of cross-screen advert platform smartclip LATAM. (German media conglomerate RTL Group still owns the remainder of smartclip’s enterprise.)

But the larger CTV deal by far was Innovid’s $160 million acquisition of TV measurement platform TVSquared to make inroads with linear advertisers. As Innovid CEO Zvika Netter informed AdExchanger on the time, CTV could also be “all the trend, however our purchasers are nonetheless spending most of their budgets in linear.”

Meanwhile, writer analytics firm Piano bought OG social media optimization platform SocialFlow, Extreme Reach acquired advertising content material and distribution firm Synchro Services, and Spotify shored up its advert providing with two podcast analytics acquisitions: Podsights and Chartable.

Vox helped shut out the month by closing its acquisition of Group9, adopted by Verisk’s purchase of id decision firm Infutor.

March

Despite the primary early indicators of an financial slowdown, the M&A practice saved chugging.

Every method of deal went down in March:

But probably the most notable deal, which rounded out Q1, was the $16 billion private equity takeover of Nielsen by Brookfield Business Partners and Evergreen Coast Capital Corp. The transfer made sense. It’s onerous to revamp Nielsen’s total enterprise whereas being publicly scrutinized by buyers and antagonized by challengers.

April

April showers introduced a small handful of acquisitions, together with a $100 million deal by OpenWeb for French native advert tech platform Adyoulike and VideoAmp’s purchase of TV analytics platform Elsy.

April showers introduced a small handful of acquisitions, together with a $100 million deal by OpenWeb for French native advert tech platform Adyoulike and VideoAmp’s purchase of TV analytics platform Elsy.

But the larger headline in April was the completion of the merger between AT&T’s WarnerMedia unit and Discovery to turn out to be the Frankenstein’s monster that’s now Warner Bros. Discovery.

Mastercard additionally closed its acquisition of Dynamic Yield, the personalization platform it purchased from McDonald’s final 12 months as a complement to SessionM, the CDP Mastercard acquired in 2019.

May

May was a blended bag and the beginning of a marked slowdown in advert tech deal exercise.

But for these preserving rating, Publicis acquired ecommerce software program Profitero, DISQO snapped up a buyer suggestions and testing tech startup referred to as Feedback Loop and lifecycle advertising platform CleverTap bought buyer engagement platform Leanplum.

Meanwhile, Blackstone, guardian firm of a number of advert tech belongings, together with Vungle and AlgoLift, was additionally busy. The non-public fairness agency agreed to buy family tree supplier Ancestry.com for $4.7 billion – together with its huge (and delicate) knowledge set – and Blackstone-backed Candle Media acquired video content material manufacturing firm ATTN: for $150 million.

June

Although there was a sprinkling of gross sales all through June, the tempo was nonetheless slackening.

Airship acquired into app retailer optimization with the acquisition of Gummicube, Pinterest acquired an AI-powered buying startup referred to as The Yes, GTCR subsidiary Dreamscape bought advert spend tracker Standard Media Index, Mediaocean acquired picture recognition platform Drishyam AI, and advert supply tech vendor Peach grabbed artistic automation startup Cape.

Also notable, Index Exchange acquired Rivr Technologies, a German advert tech startup that builds brand-specific bidding algorithms primarily based on an advertiser’s KPIs and particular enterprise objectives. Rivr was Index’s first-ever acquisition.

Oh, and enjoyable truth: AT&T completed its sale of Xandr to Microsoft. Less than two months later, Netflix would select Microsoft as its advert tech and gross sales associate to assist the streamer’s AVOD ambitions.

July

July

To transfer from a enjoyable truth to a sobering stat: Excluding digital content material, M&A exercise was down 21% quarter-over-quarter and down 24% YoY, in keeping with LUMA’s Q2 2022 market report.

And, spoiler alert, complete deal quantity could be down in the third quarter in contrast with Q2, largely resulting from a drop-off in digital content material offers, as per LUMA. (Even so, occasions and publishing firm Informa did buy B2B writer Industry Dive for a cool $525 million in mid-July.)

Yet, should you get away advert tech, deal volume actually increased quarter-over-quarter in Q3, together with:

- Tremor’s acquisition from SingTel of TV-focused cellular advertising platform Amobee for $239 million.

- Verve Group’s purchase of Dataseat, a cellular DSP that helps builders carry cellular programmatic in-house.

- Goodway Group’s acquisition (its second this 12 months and ever) of Canton Marketing Solutions, a consultancy that helps purchasers in-house their digital advertising and programmatic media.

- Podcast internet hosting and analytics platform Acast’s purchase of podcast database Podchaser for $27 million.

- Brand security vendor Zefr’s acquisition of AdVerif.ai, a startup that helps determine misinformation on social platforms.

- Human’s merger with cybersecurity and fraud detection service PerimeterX.

- And Unity’s plan to acquire ironSource for $4.4 billion. (More on that little cleaning soap opera beneath.)

August

Regardless of downward stress on valuations (which was arguably essential after advert tech valuations shot through the roof in 2021), the summer season closed with a bit of warmth.

Customer knowledge platform mParticle acquired Vidora, a buyer personalization platform; Criteo completed its acquisition of IPONWEB; Mediaocean introduced plans to acquire video advert rendering firm Imposium; and cellular measurement supplier Branch bought AdLibertas, a first-party knowledge platform for app builders.

On the media entrance, Axios sold to Cox Enterprises for $525 million, and Sony did two large issues: It completed its $37 billion acquisition of online game developer Bungie (well-known for many of the Halo titles) and, individually, acquired cellular gaming developer Savage Game Studios.

But again to advert tech – oh, the drama.

In early August, AppLovin offered to purchase Unity in an all-stock merger valuing the corporate at $20 billion, however solely as long as Unity didn’t merge with ironSource. Just a few days later, Unity’s board of administrators rejected AppLovin’s bid and reaffirmed the corporate’s dedication to mix with ironSource.

September

Ad tech offers had been skinny on the bottom in September, though there have been a couple of notables, together with an announcement by PE agency Bridgepoint of its plan to take a majority stake in programmatic media platform MiQ.

And PubMatic made its first acquisition in more than eight years, taking up the media measurement and reporting platform Martin.

And PubMatic made its first acquisition in more than eight years, taking up the media measurement and reporting platform Martin.

Zynga, now owned by online game holding firm Take-Two Interactive, bought itself an app retailer optimization platform referred to as Storemaven, Reddit acquired contextual promoting startup Spiketrap, and Instacart added AI pricing and promotion supplier Eversight to its cart.

October

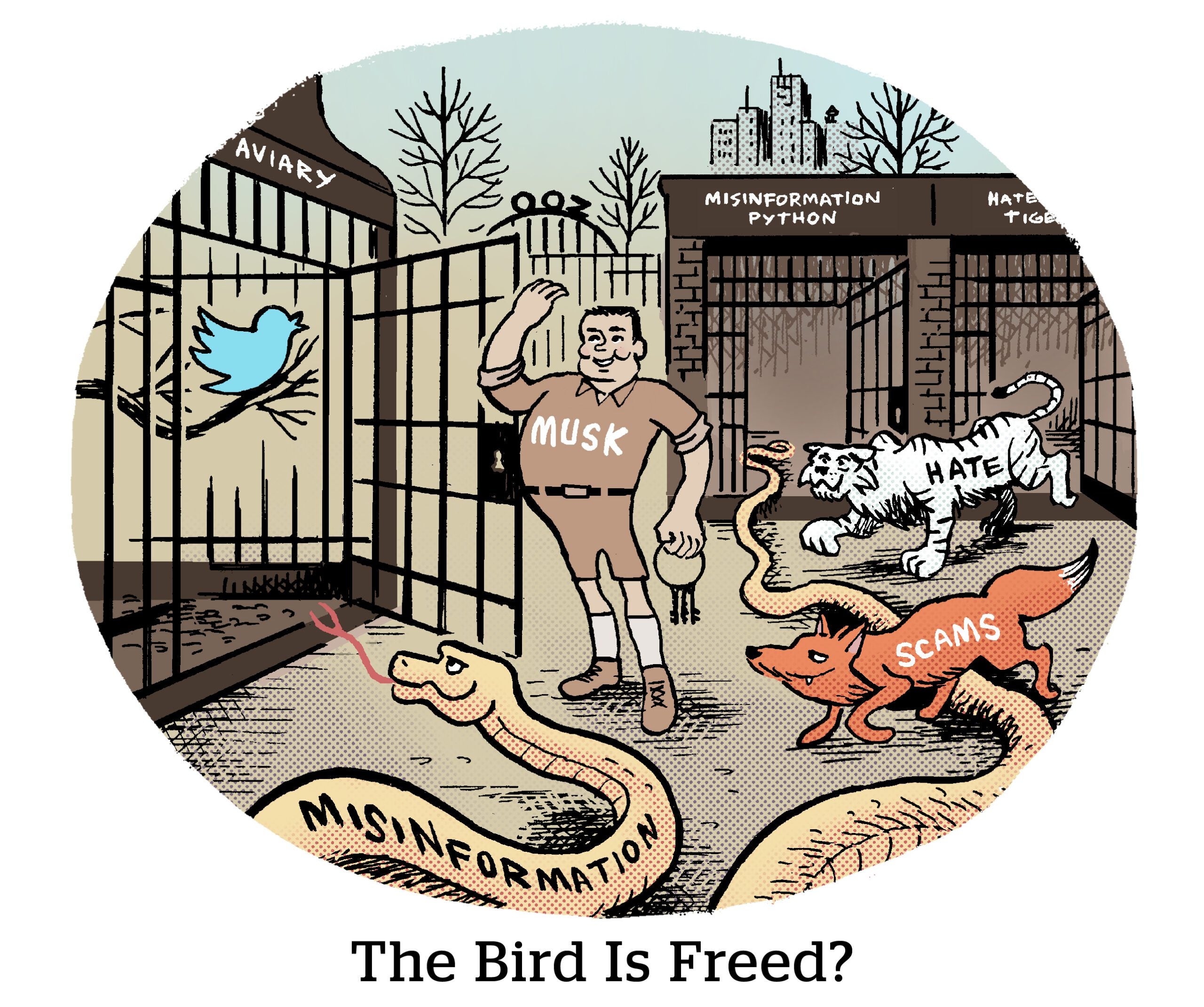

But right here’s a query: What does Elon Musk have in frequent with Kroger?

They’re each placing billions behind a imaginative and prescient.

Musk’s imaginative and prescient apparently includes pouring gasoline on his $44 billion acquisition of Twitter, tossing in a lighted match and seeing what happens.

Kroger’s imaginative and prescient is to mix with rival grocery chain Albertsons in a $24.6 billion merger as a part of a bid to turn out to be the retail media network to end all retail media networks.

November

Proceeding apace, Human saved up its mini-spree with the acquisition of anti-malvertising and ecommerce fraud startup clear.io, Samba TV bought a startup referred to as Disruptel for ACR-based measurement, and eyeo – the Cologne-based proprietor of Adblock Plus – acquired advert block income restoration firm Blockthrough.

Also, Walt Disney Co. paid $900 million to purchase Major League Baseball’s remaining 15% stake in BAMTech, the streaming tech supplier that powers Disney+, Hulu and ESPN.

And the season finale of “Love Island: Love Triangle” aired in November, throughout which Unity officially closed its acquisition of ironSource. (AppLovin was not invited to the marriage.)

And the season finale of “Love Island: Love Triangle” aired in November, throughout which Unity officially closed its acquisition of ironSource. (AppLovin was not invited to the marriage.)

December

And so the 12 months has come to a detailed, ending far quieter than it started.

But search market Ad.web did acquire IntentX, a commerce platform for publishers, with the intent to assist pubs develop their visitors and diversify income streams, and meme specialist (sure, this can be a factor) Doing Things Media announced its plan to purchase social media content material model Overheard.

Here’s to publishers having a greater time of it in 2023 than they did in 2022.

If you bought to the top of this text, you deserve a cookie. But not a third-party cookie, clearly. Like, an actual cookie. Seriously, head to the kitchen, go spend a while with your loved ones or watch a bit of Netflix – and we’ll see you subsequent 12 months!

https://information.google.com/__i/rss/rd/articles/CBMiU2h0dHBzOi8vd3d3LmFkZXhjaGFuZ2VyLmNvbS9pbnZlc3RtZW50L21hLWluLTIwMjItdGhlLXllYXItYWQtdGVjaC1zbG93ZWQtaXRzLXJvbGwv0gEA?oc=5