(Ad) Tax season arrives each April with out fail—and so does the panic of many tax preparers and accountants who immediately notice they do not have an efficient advertising plan in place and vow to do higher the following time round.

That’s as a result of having a transparent and complete advertising technique for tax companies means you will have loads of nice shoppers coming within the door commonly and will not want to fear about how your organization is doing yearly.

But what’s one of the simplest ways to strategy marketing for CPAs, accountants, and tax professionals? We’ve obtained all of the solutions and in-depth data you want proper right here.

When to Create a Marketing Plan for Your Tax Business

Marketing for tax professionals is commonly top-of-mind within the month or two main up to April’s basic tax submitting deadline. But that is a mistake—many purchasers have already chosen a tax preparer by then and are not keen to change suppliers on the final minute.

It’s important to focus in your advertising technique forward of tax season as a result of when the tax prep season begins, you doubtless will not have the time or the psychological area to create a very efficient advertising marketing campaign.

Investing in a year-round advertising plan will guarantee you’ve a gentle circulate of shoppers and do not want to scramble throughout your busiest time of yr to carry in additional enterprise. You ought to ideally start implementing your advertising technique within the fall, so you’ve loads of time to see what’s working, make changes accordingly, and begin bringing in new shoppers forward of the following tax season.

9 Marketing Strategies for Tax Professionals

1. Understand Your Target Audience

Before contemplating your advertising techniques, you should decide who’s in your goal marketplace for tax preparation and accounting companies. With such a variety of individuals utilizing tax companies for various causes, discovering your perfect consumer profile will assist you to attain exactly the correct individuals so your advertising is more practical.

For instance, when you focus your tax preparation companies on small business owners, you will have to analysis the place they spend their time—email marketing and LinkedIn posts and ads will doubtless work properly. But those self same channels will not work as properly when you’re concentrating on middle-class taxpayers in your space. So, figuring out who you need to attain and what messages will resonate with them is a vital first step.

Source: Chahal & Associates

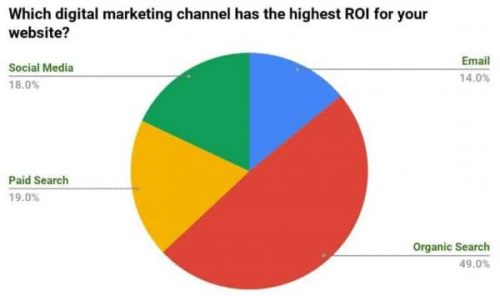

2. search engine optimisation

(*9*) (search engine optimisation) can appear intimidating when you’re unfamiliar with it. But it boils down to a easy idea—guaranteeing that search engines like google and yahoo and the individuals utilizing them can simply discover your enterprise and perceive what you are about.

SEO for tax professionals means guaranteeing you’ve an informative and user-friendly web site describing your companies and strategy to tax preparation intimately. Keep your web site and content material up to date to assist your search engine optimisation efforts, and bear in mind to focus in your technical SEO. Content advertising (extra information coming under!) is a good way to enhance your search engine optimisation.

3. Organic And Paid Social

Social media is a software that many conventional companies, like tax preparers and professionals, have shied away from. But it is best to discover no less than one or two social platforms to enhance your model consciousness and think about investing in organic and paid content. You do not want to develop into a TikTok influencer, however operating a couple of Facebook ads or cultivating an expert LinkedIn presence could be nice methods to acquire new shoppers.

Social media will also be an excellent supply of tax preparer and accountant advertising concepts. Get impressed by testing what different tax professionals have created on the platforms the place your shoppers spend time—copying is a poor enterprise apply however seeing how others within the subject have discovered artistic approaches could be useful.

Source: Ntegrity Financial Group, LLC

4. Email Marketing

Email marketing is a potent software for accountants and tax preparers. It provides you a manner to attain out to a extremely focused viewers with reminders of upcoming deadlines, service descriptions, and provides round tax season.

But a very good email marketing strategy for tax preparers and professionals ought to have year-round messaging. You also can embrace hyperlinks to weblog posts out of your content marketing technique, social posts, or behind-the-scenes glimpses of your employees to construct relationships all year long together with your customers.

5. Print Advertising

Direct mail and newspaper advertising has been round longer than e mail advertising, however they’re nonetheless a good way to attain potential local customers.

If your tax preparation enterprise focuses on offering companies to individuals in your space, junk mail is an effective manner to construct model consciousness and ship out provides for your enterprise. You also can ship reminders about tax season and upcoming deadlines.

Print advertising can be a great complement to your digital marketing—they work properly collectively. Contact us to study extra about junk mail and newspaper commercials with the San Francisco Chronicle.

Source: 99designs

6. Content Marketing

Content marketing is an underrated advertising software for tax professionals. You can create weblog posts providing insights and recommendation in your chosen tax space, so potential shoppers trying to find related data can discover your website.

Of course, tax recommendation is very private and customised, so you do not want to provide full options in each submit. But you may write about frequent subjects and provides an summary to educate your prospects and present clients and reveal your deep experience. Just be certain to put an excellent call-to-action on the finish so curious readers can contact you about utilizing your companies proper there.

Source: 1040.com

7. Reputation Management

For monetary service suppliers like tax preparers and accountants, having a reliable popularity is all the things. Customers carry you a few of the most personal details about their lives and put their monetary future and popularity in your palms. That’s why your online reputation must be spotless to get essentially the most outcomes out of your advertising.

Managing your online reputation is a should—it is best to no less than arrange your Google My Business profile and cope with any negative reviews there promptly. You also can attempt a few of these tips for trust-building marketing. And guarantee any content material you share on any platform is freed from bias, hyperbole, and clickbait. Educational and correct content material solely, though, in fact, it could actually have character and creativity as properly.

8. PPC

If you want to herald new clients quick, or in case your tax preparation or accounting enterprise is brand-new, you won’t have time to construct model consciousness with natural social content material and weblog posts. Running pay-per-click (PPC) ads can get you precise outcomes nearly instantly since you’re paying to have your content material rank greater instantly. You can goal your ads to specific demographics, areas, or interests so that you’re certain your content material will get seen by your perfect viewers. Make certain your advertisements look reliable and authoritative so potential shoppers know they’ll belief you.

9. Retargeting

Prospects who see your content material however want extra time to be prepared to rent a brand new tax professional instantly aren’t misplaced endlessly when you use retargeting ads. These advertisements run by way of Facebook or Google and serve ads to individuals who have already engaged together with your content material.

It means you are spending your ad budget solely on essentially the most individuals who have a excessive likelihood of changing to clients quickly. Retargeting is nice in case your advertising technique delivers loads of clicks and eyeballs however not changing in addition to you hoped.

Marketing Strategies for Tax Professionals: Key Takeaways

Marketing for tax professionals can look sophisticated and intimidating, however it does not want to be.

- Start by wanting intently at your perfect buyer—what are their tax wants, and what sort of resolution are they looking for? Answering these questions will assist you to discover the channels and messages that may propel them to take motion and rent you.

- Combine two or extra channels for greatest outcomes—for instance, attempt investing in content material writing and e mail advertising to allow them to work collectively to provide the greatest outcomes whenever you e mail out your newest weblog posts. But do not attempt to do all the things without delay. It’s higher to begin slowly and increase as you get every channel proper.

- Trustworthiness is all the things—your advertising wants to present potential clients they’ll belief your enterprise with their delicate monetary data, so your advertising should take that belief as severely as you do in your work.

How Hearst Bay Area Can Help

If you are a tax skilled who wants assist creating and operating an efficient advertising marketing campaign, you are not alone! Doing it proper takes time and experience, and also you’re busy constructing your enterprise. Hearst Bay Area is right here to assist—we deal with the advertising technique and execution so you may concentrate on serving your shoppers.

Contact us at this time to learn the way we will develop your enterprise with print and digital advertising and different marketing solutions.

https://information.google.com/__i/rss/rd/articles/CBMiXWh0dHBzOi8vd3d3LnNmZ2F0ZS5jb20vbWFya2V0L2FydGljbGUvbWFya2V0aW5nLXN0cmF0ZWdpZXMtZm9yLXRheC1wcm9mZXNzaW9uYWxzLTE3NjY5ODczLnBocNIBAA?oc=5