Oversold shares are what their identify implies: shares which have traded decrease than they need to, primarily based on their fundamentals. It’s a subjective measure, in fact; in any case, for each vendor, there’s a purchaser. The key to success in shopping for into an oversold inventory is recognizing when it’s getting close to the underside. These shares sometimes make a comeback, even when they take their time about it. But as soon as they do bounce, the potential for robust features could be very actual.

We can test with Wall Street’s inventory analysts to seek out which bargain-priced shares are primed for features. Once we all know which shares the specialists advocate, we are able to begin digging into their particulars. The information instruments at TipRanks are perfect for this, letting us type out shares by a variety of things. The inventory information plus the analyst commentary will collectively paint a complete image of any inventory – an important step earlier than investing.

So let’s put that into apply. We’ve seemed up the small print on three shares whose value is near a one-year low – however which all have a Moderate or Strong Buy score from the analyst neighborhood, and a one-year upside potential of a minimum of 90%. Let’s take a more in-depth look.

Criteo SA (CRTO)

We’ll begin with Paris-based Criteo, an AI-powered on-line commerce and promoting media firm. Criteo employs some 2,700 folks, operates in 96 international locations, and its industrial media advert show platform boasts over 685 million customers per day together with 35 billion day by day shopping and shopping for occasions. The firm makes use of information evaluation to drive efficient industrial outcomes, and to complement the patron’s web expertise. Criteo operates on the favored pay-per-click (PPC)/cost-per-click (CPC) fashions.

Criteo has seen constant robust revenues over the previous few years. The high line in 2020 got here in at $2.08 billion, and that improved to $2.25 billion in 2021. Last 12 months, the primary three quarters all confirmed year-over-year income features.

This autumn, nevertheless, confirmed a slight drop in income from the prior 12 months. The 4Q21 high line got here in at $653 million, down from $663 million in 4Q20. While revenues dropped barely in that closing quarter, adjusted EPS rose. Earnings had been reported at 98 cents per share in 4Q20, rising to $1.44 per share in 4Q21.

Investors ought to notice that CRTO shares hit a peak worth in December of final 12 months, and since then have been falling. The inventory is down 37% within the final three months.

Berenberg analyst Sarah Simon is unworried by the autumn in share costs, and sees it as an opportunity for buyers to maneuver in on the inventory.

“While Criteo is ready to ship double-digit progress in 2022, with an accelerating run-rate because the 12 months progresses, the inventory is valued as whether it is going out of enterprise. We proceed to consider that Criteo is nicely positioned to climate the deprecation of third-party identifiers, together with that which was introduced by Google final week, given its evolving enterprise combine and in depth first-party integrations. Valuation utterly fails to replicate this, in our view,” Simon opined.

These feedback help Simon’s Buy score, whereas her $66 value goal point out potential for a powerful 153% upside within the 12 months forward. (To watch Simon’s monitor document, click here)

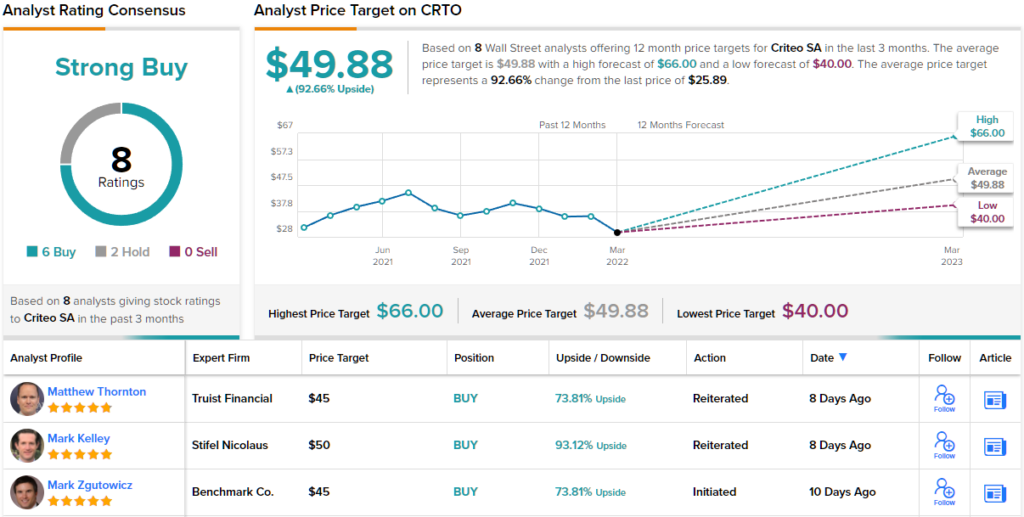

The Strong Buy consensus score, primarily based on a 6 to 2 break up between Buys and Holds, exhibits that Wall Street, too, is bullish right here. The inventory is promoting for $25.89 and its $49.88 common value goal suggests it has a one-year upside of ~91%. (See CRTO stock forecast on TipRanks)

RingCentral, Inc. (RNG)

Let’s shift gears, and check out a tech firm. RingCentral is an SaaS agency, bringing telecom to the desktop pc and the workplace community server, providing a spread of enterprise communications options – cellphone strains, extensions, name forwarding, video calling, display screen sharing – making them appropriate with widespread purposes like Outlook, Salesforce, and Google Docs, and giving clients the entire bundle on the cloud. It’s enterprise telecom can be out there on an app.

RingCentral has seen 8 consecutive quarters of top-line income progress, with final quarter, 4Q21, coming in at $448 million for a 34% year-over-year acquire. Quarterly earnings had been additionally robust – at 39 cents per diluted share, EPS beat the 37-cent forecast and grew 34% from 4Q20.

Full 12 months outcomes from 2021 had been additionally strong. Revenue was up 35% y/y, to $1.6 billion. That whole was pushed by a 36% acquire in subscription income, which hit $1.5 billion within the 12 months. Adjusted EPS for the 12 months was $1.34, up from 98 cents within the prior 12 months.

Now look again on the description of RingCentral’s product and repair, and the rationale for the surge in gross sales and earnings is obvious. This firm was beautifully suited to thrive through the work-from-home push within the corona disaster. However, the prospect of a ‘return to regular’ has buyers frightened that RingCentral will see a decline in gross sales as workplace areas reopen. For the previous 12 months, the inventory is down ~70%.

5-star analyst Terry Tillman, of Truist, believes that the worth decline in RNG is a shopping for alternative, and he’s not shy to say so.

“The firm has remained a mannequin of execution, beating numbers and elevating its outlook on an ongoing foundation. The firm has confirmed to be a sustained 30%-plus grower for nicely over a decade, and we definitely anticipate the upside case in 2022 to replicate comparable progress/momentum… Currently, the shares commerce at a significant low cost to 30%-plus growers… We advocate buyers purchase the shares owing to elevated confidence in sustained robust top-line progress whereas displaying revenue and money move development,” Tillman wrote.

In line with this upbeat outlook, Tillman charges RingCentral’s shares a Buy, describing it as ‘robust by virtually any measure.’ His $295 value goal suggests an upside of ~181% within the subsequent 12 months. (To watch Tillman’s monitor document, click here)

Overall, RingCentral has a stellar fame within the tech world, and has attracted no fewer than 23 scores from Wall Street’s analysts. These embrace 20 Buys in opposition to 3 Holds, for a Strong Buy consensus view. RNG has a mean value goal of $235.48, implying ~125% upside from the $104.95 buying and selling value. (See RNG stock forecast on TipRanks)

NeoGames (NGMS)

For the final inventory on our record, we’ll stick to the tech sector – however take a look at a side of it as totally different from RingCentral as an organization can get. NeoGames, with 15 years’ expertise, is a tech supplier for the iLottery area of interest, making gaming options out there for national- and state-regulated lotteries. These video games have lengthy been widespread, and that recognition has readily transferred to the web world. NeoGames has capitalized on that reality – and has gathered over 42 million participant accounts.

To elevate capital, the corporate went public in November of 2020. It introduced preliminary pricing of the providing at $17 per share, to promote simply over 4.8 million shares; within the occasion, NeoGames bought over 5.5 million shares, and raised $94 million.

Since the IPO, nevertheless, NeoGames has seen revenues and earnings decline, together with share value. From the fourth quarter of 2020 to the fourth quarter of 2021, the highest line fell from $14 million to $12 million. Worse, the corporate posted a ‘complete loss’ in 4Q21 of 14 cents per share, evaluating unfavorably to the 10-cent EPS revenue of the year-ago quarter, and much beneath the 9-cent revenue anticipated. The inventory peaked in worth above $70 per share in June of 2021, and is presently down 80% from that degree.

Stifel’s Steven Wieczynski, rated 5-stars by TipRanks, believes that this inventory is a real discount for buyers, and that the perceived danger is price it when in comparison with upcoming acquire potential.

“NGMS shares have are available in significantly since their mid-2021 highs, pushed by a mix of things together with 1) fading stay-at-home demand tailwinds, 2) restricted new state catalysts, 3) decelerating margins, in addition to extra just lately 4) doubtlessly rising rates of interest, and 5) geopolitical pushed risk-off market. We consider sentiment on stock-specific headwinds has probably bottomed out, with extraordinarily conservative present valuation affording buyers a possibility to play a multi-year secular progress story with 1) appreciable limitations to entry, 2) steady, predictable, and sturdy margins and FCF conversion, and 3) nonetheless forthcoming new state catalysts,” Wieczynski defined.

To this finish, Wieczynski provides NeoGames a Buy score with a $34 value goal that signifies room for ~144% upside by the top of 2022. (To watch Wieczynski’s monitor document, click here)

While there are solely 3 evaluations of this inventory on document, all of them agree on the bullish aspect, making the Strong Buy consensus score unanimous. NeoGames is buying and selling for $13.96 and its $36.67 common value goal recommend it has a 163% one-year upside potential. (See NeoGames stock forecast on TipRanks)

To discover good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.

https://www.tipranks.com/information/article/3-wildly-oversold-stocks-that-could-explode-higher/