Get inside Wall Street with StreetInsider Premium. Claim your 1-week free trial here.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal 12 months ended April 30, 2021

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition interval from _____________ to _____________

Commission

File Number: 333-214463

SLINGER

BAG INC.

(Exact

identify of registrant as laid out in its constitution)

| Nevada | 61-1789640 | |

|

(State incorporation |

(I.R.S. Identification |

2709

NORTH ROLLING ROAD, SUITE 138

WINDSOR

MILL

MARYLAND

21244

(Address

of principal government places of work, together with Zip Code)

(443)

407-7564

(Registrant’s

Telephone Number, together with Area Code)

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by examine mark if the registrant is a widely known seasoned issuer, as outlined in Rule 405 of the Securities Act. Yes [ ] No

[X]

Indicate

by examine mark if the registrant just isn’t required to file stories pursuant to Section 13 or Section 15(d) of the Act. Yes [X] No

[ ]

Indicate

by examine mark whether or not the registrant (1) has filed all stories required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 in the course of the previous 12 months (or for such shorter interval that the registrant was required to file such stories), and (2)

has been topic to such submitting necessities for the previous 90 days. Yes [X] No [ ]

The

registrant is a voluntary filer of stories below Section 13 or 15(d) of the Securities Exchange Act of 1934 and has filed in the course of the

previous 12 months all stories it might have been required to file by Section 13 or 15(d) of the Securities Exchange Act of 1934 if

the registrant had been topic to one in all such Sections.

Indicate

by examine mark whether or not the registrant has submitted electronically each Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) in the course of the previous 12 months (or for such shorter interval that the registrant

was required to submit such recordsdata). Yes [X] No [ ]

Indicate

by examine mark whether or not the registrant is a big accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

firm, or an rising progress firm. See the definitions of “massive accelerated filer,” “accelerated filer,”

“smaller reporting firm,” and “rising progress firm” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] |

Accelerated filer [ ] |

| Non-accelerated filer [ ] |

Smaller reporting firm [X] |

| Emerging progress firm [X] |

If

an rising progress firm, point out by examine mark if the registrant has elected to not use the prolonged transition interval for complying

with any new or revised monetary accounting requirements offered pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by

examine mark whether or not the registrant has filed a report on and attestation to its administration’s evaluation of the effectiveness of

its inside management over monetary reporting below Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public

accounting agency that ready or issued its audit report. [ ]

Indicate

by examine mark whether or not the registrant is a shell firm (as outlined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The

mixture market worth of the frequent fairness voting shares of the registrant held by non-affiliates on October 31, 2020, the registrant’s

most not too long ago accomplished second fiscal quarter, was roughly $28,206,297.

The

variety of shares excellent of the registrant’s Common Stock, $0.001 par worth per share, as of July 31, 2021, was 29,979,573.

CAUTIONARY

STATEMENT REGARDING FORWARD LOOKING INFORMATION

This

report accommodates forward-looking statements inside the which means of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. The phrases “imagine,” “count on,” “anticipate,” “intend,” “estimate,”

“might,” “ought to,” “may,” “will,” “plan,” “future,” “proceed,”

and different expressions which can be predictions of or point out future occasions and traits and that don’t relate to historic issues determine

forward-looking statements. These forward-looking statements are primarily based largely on our expectations or forecasts of future occasions, can

be affected by inaccurate assumptions, and are topic to numerous enterprise dangers and identified and unknown uncertainties, a lot of which

are past our management. Therefore, precise outcomes may differ materially from the forward-looking statements contained on this doc,

and readers are cautioned to not place undue reliance on such forward-looking statements. We undertake no obligation to publicly replace

or revise any forward-looking statements, whether or not on account of new info, future occasions or in any other case. All kinds of things

may trigger or contribute to such variations and will adversely impression revenues, profitability, money flows and capital wants. There

might be no assurance that the forward-looking statements contained on this doc will, the truth is, transpire or show to be correct.

These statements are solely predictions and contain identified and unknown dangers, uncertainties and different components, together with the dangers within the

part entitled “Risk Factors” that will trigger our or our trade’s precise outcomes, ranges of exercise, efficiency

or achievements to be materially completely different from any future outcomes, ranges of exercise, efficiency or achievements expressed or implied

by any forward-looking statements.

Important

components that will trigger the precise outcomes to vary from the forward-looking statements, projections or different expectations embrace, however

usually are not restricted to, the next:

| ● | danger that we won’t be able to remediate recognized materials weaknesses in our inside management over monetary reporting and disclosure controls and procedures; |

|

| ● | danger that we fail to fulfill the necessities of the agreements below which we acquired our enterprise pursuits, together with any money funds to the enterprise operations, which may consequence within the lack of our proper to proceed to function or develop the precise companies described within the agreements; |

|

| ● | danger that we’ll be unable to safe further financing within the close to future with a view to start and maintain our deliberate growth and progress plans; |

|

| ● | danger that we can’t entice, retain and inspire certified personnel, significantly workers, consultants and contractors for our operations; |

|

| ● | dangers and uncertainties referring to the assorted industries and operations we’re at present engaged in; |

|

| ● | outcomes of preliminary feasibility, pre-feasibility and feasibility research, and the likelihood that future progress, growth or enlargement is not going to be in keeping with our expectations; |

|

| ● | dangers associated to the inherent uncertainty of enterprise operations together with revenue, price of products, manufacturing prices and price estimates and the potential for sudden prices and bills; |

|

| ● | dangers associated to commodity worth fluctuations; |

|

| ● | the uncertainty of profitability primarily based upon our historical past of losses; |

|

| ● | dangers associated to failure to acquire satisfactory financing on a well timed foundation and on acceptable phrases for our deliberate growth initiatives; |

|

| ● | dangers associated to environmental regulation and legal responsibility; |

|

| ● | dangers associated to tax assessments; |

|

| ● |

different dangers and uncertainties associated to our prospects, properties and enterprise technique. |

Although

we imagine that the expectations mirrored within the forward-looking statements are affordable, we can’t assure future outcomes, ranges

of exercise, efficiency or achievements. You shouldn’t place undue reliance on these forward-looking statements, which communicate solely as

of the date of this report. Except as required by regulation, we don’t undertake to replace or revise any of the forward-looking statements

to evolve these statements to precise outcomes, whether or not on account of new info, future occasions or in any other case.

As

used on this report, the “Company,” “we,” “us,” or “our” consult with Singer Bag Inc., until

in any other case indicated.

SLINGER

BAG INC. (FORMERLY KNOWN AS LAZEX INC.)

SLINGER

BAG INC.

Annual

Report on Form 10-K for the

Fiscal

Year Ended April 30, 2021

The

following evaluation of our monetary situation and outcomes of operations must be learn along with our monetary statements and

the associated notes thereto contained elsewhere on this Form 10-K, in addition to the chance components included on this Form 10-K.

History

of our Company

Lazex

Inc. (the “Company” or “Slinger”), was fashioned on July 12, 2015 as a Nevada company. From its inception till

September 13, 2019, the Company was within the enterprise of offering journey consulting and tour information

providers. On September 16, 2019, Slinger Bag Americas Inc. (“Slinger Bag Americas”) acquired

20,000,000 shares of the Company’s frequent inventory from its then shareholders. On September 16, 2019, the Company acquired

100% of the excellent shares of Slinger Bag Americas when the then proprietor of Slinger Bag Americas contributed her shares of Slinger

Bag Americas to the Company in alternate for 20,000,000 shares of the Company. The results of the foregoing transactions is that Slinger

Bag Americas turned a wholly-owned subsidiary of the Company. From September 16, 2019 and onward, the Company ceased its efficiency

of journey consulting and tour information providers and has switched its focus to the event of the applied sciences and merchandise owned by

Slinger Bag Americas and its associates.

On

February 10, 2020, Slinger Bag Americas acquired a 100% possession stake in Slinger Bag Ltd (“SBL”). SBL owns the mental

property rights pertaining to the Slinger Launcher (described extra absolutely under) and was accountable for the Kickstarter marketing campaign described

extra absolutely under.

On

February 25, 2020, the Company elevated the variety of approved shares of Common Stock from 75,000,000

to 300,000,000 and effected a 4-1 ahead break up of its excellent shares of frequent inventory. Approval of the Company’s stockholders

was not required to be obtained, as approved by Nevada Revised Statute Section 78.207, et seq. The ahead break up turned efficient on

February 25, 2020. As a results of the ahead inventory break up, every share of the Company’s frequent inventory excellent has been break up

into 4 shares of the Company’s frequent inventory. All references on this report back to numbers of shares replicate the Company’s

4-1 ahead break up.

Through

its possession of Slinger Bag Americas and SBL, Slinger is the proprietor of the Slinger Launcher and is targeted on the Ball Sport Market globally.

Slinger has developed and patented a extremely moveable and inexpensive ball launcher constructed into a straightforward to move wheeled trolley bag

(the “Slinger Launcher”). The Slinger Launcher permits anybody to easily and simply management the pace, frequency and elevation

of balls which can be launched for observe, coaching or health functions.

Slinger

has initially targeted all its energies on the Tennis market worldwide, however is within the early levels of creating ball launchers for different

ball sports activities.

For

the common tennis participant, the Slinger Launcher is rather more than a tennis ball launcher. It additionally capabilities as an entire tennis bag

with ample room for racquets, sneakers, towels, water bottles and different equipment and might cost cell phones and different gadgets.

Tennis

Ball machines have been round because the 1950’s once they have been launched by Renne Lacoste. Improvements to efficiency have been made

within the 1970’s when Prince began its tennis enterprise on the again of its first product – Little Prince – which was

a vacuum operated ball machine. In the 1990’s the primary battery operated machines got here to the market and since that point little or no,

if something, has modified within the construction of ball machines merchandise exterior of added computerization. Typically, the machines being marketed

by conventional ball machine manufacturers are massive, cumbersome and awkward to function. They are additionally very costly – usually effectively above

U.S. $1,000. Up till in the present day 99% of all tennis ball machines have offered to tennis services, with just a few being offered on to tennis

enjoying shoppers.

According

to the Tennis Industry Association (www.tia.org) the one largest problem dealing with tennis participation is the truth that 34% of lapsed

gamers cited a “lack of a enjoying associate” as the explanation for them stopping enjoying tennis. The Slinger Launcher goes a protracted

approach to fixing this challenge.

The

international tennis market is regarded by trade consultants, governing organizations, Tennis manufacturers and tennis-specific market analysis corporations

as having 100 million energetic gamers globally, with as many shoppers once more being avid followers of the game. Of this 100 million tennis

participant market, 20 million gamers are considered frequent or avid gamers – gamers who play repeatedly – not less than 1 time per 30 days.

These avid gamers drive the overall tennis trade and account for 80% of all tennis revenues worldwide.

It

is that this avid participant market that Slinger is targeted on penetrating with its Slinger Launcher and related tennis equipment.

Slinger

intends to disrupt this conventional tennis market by creating a brand new ball machine class – known as Slinger Launcher – and

advertising moveable and inexpensive Slinger Launchers on to avid, common tennis gamers. Constructed inside a wheeled trolley tennis

bag, a Slinger Launcher weighs round 15kgs / 34lbs when empty. If saved with 72 balls inside the burden will increase to 19kgs / 42lbs.

It can simply be saved in a automobile trunk, wheeled to the courtroom and arrange inside minutes to make use of. The Slinger Launcher is powered by a 6.6Ah

Lithium battery that may last as long as 3.5 hours of play relying on the settings getting used and on frequency of use. Slinger Launcher’s

comfort as a tennis bag mixed with its ease of operation and total efficiency as a tennis ball launcher is the premise that the

Company will goal direct gross sales to those avid gamers.

While

the preliminary model focus is clearly on tennis, Slinger is creating comparable launchers to deal with different types of tennis across the globe

which can be both quickly gaining new individuals or are already well-established sports activities in their very own proper. These embrace, however usually are not

restricted to, Pickleball (USA), Soft Tennis (Japan), Squash (International Markets) and Paddle Tennis (International markets) all of which

are at present in both growth or testing and deliberate for introduction in calendar 2022.

On

December 3, 2020, Slinger signed an unique settlement with Flixsense Pty Limited d/b/a Gameface for the event of a tennis particular

synthetic intelligence (AI) utility. Slinger intends to introduce a market disrupting tennis app for gamers of all ages and skills.

This app will present a variety of analytics and different providers and embrace observe and tennis health drills and actions, teaching

suggestions and recommendation and a full suite of AI analytics. Slinger will provide some providers freed from cost and can construct a tiered subscription

mannequin for others. The app is anticipated to be able to launch to the market later in calendar 2021.

In

future years, the Company plans to enter new ball sport markets corresponding to baseball, softball, cricket, badminton and others.

Slinger’s

manufacturing capability was initially roughly 2,000 models per 30 days, however with enhancements and efficiencies within the manufacturing

processes throughout all vendor companions, the month-to-month manufacturing capability rose to over 3,000 within the final fiscal quarter and present capability

is now over 5,000 models per 30 days, which is able to help Slinger’s future gross sales targets.

Slinger

delivers Slinger Launchers instantly from the ultimate meeting facility in Xiamen, China to prospects both by direct cargo from the

port in China, or to 3rd get together logistics services in Columbia SC (USA) to help our US enterprise, Belleville, Ontario, Canada, Rotterdam,

The Netherlands to help smaller distributors in Canada, Europe, Middle East, Africa, and lastly to Israel.

Additionally,

we ship full containers of our Slinger Triniti Tennis Balls from Wilson (our provider) in Thailand to the United States for onward distribution.

The

Company has contracted with unique distributors globally. These embrace Japan, UK, Ireland, Switzerland, Scandinavian markets (masking

Denmark, Sweden, Norway, Finland) Australia, New Zealand, Bulgaria, Czech Republic, Singapore, Morocco, Slovenia, Slovkian Republic,

Hungary, Croatia, Germany, Austria, France, Italy, Spain, Portugal, Netherlands, Belgium and Luxembourg, Russia, Middle East GCC markets,

Egypt, Bangladesh, Pakistan, Malaysia Czech and Slovak Republics, Greece, Panama, South Africa, Hong Kong, Macau and China

and we’re in varied levels of negotiation with different potential market distribution corporations throughout the globe. Manufacturing

manufacturing stays at full capability – at present 5,000 models per 30 days and Slinger has merchandise leaving our manufacturing facility

in Xiamen, China on a weekly foundation en-route to our distribution facilities within the United States and Europe and to our key distributor companions.

Our

principal government workplace is situated at 2709 N. Rolling Road, Suite 138, Windsor Mill, MD 21244, and our phone quantity is 443-407-7564.

Strategy

The

Company has a possibility to disrupt the normal tennis market globally. The Company expects to drive 80% of its international revenues

via its direct-to-consumer go-to-market technique, whether or not that be via its on-line e-commerce platform at www.slingerbag.com

or via related e-commerce platforms established and managed by its distribution community. The steadiness of revenues will likely be pushed

via partnerships with main wholesalers, federations and educating professional organizations and different transactions throughout varied markets.

The Company will function a third-party distributor construction in all markets except for the United States, the most important tennis

market globally, Canada and its founder’s house market of Israel. Distributor companions may have unique territories and can

have a acknowledged background inside the tennis trade for his or her market in addition to having the monetary capability and repair infrastructure

to aggressively develop the Slinger model. Uniquely within the sports activities trade, all client orders obtained into Slingerbag.com from markets

exterior the United States will likely be routed again to our native distribution companions to satisfy and to service their native prospects. All

distributor companions will buy with superior orders, both primarily based on a vendor-direct FOB Asia direct ship or via 1 of our 3 international

3rd get together distribution services on an obligation paid foundation and at premium price worth. Currently, the Company has signed a quantity

of unique distribution agreements in key markets and has on-going discussions with different key potential distributor companions

in different markets across the globe and is seeking to shut these distribution preparations within the coming months.

The

United States market will stay a direct-to-consumer marketplace for Slinger. As the most important tennis market on the earth with 17.4 million

gamers of which 10.5 million are common / avid gamers, the United States is a key market each to determine the Slinger model and to

drive demonstrable progress. Recently the trade reported a major enhance in US tennis participation and total variety of tennis

play events, one thing that has been replicated in different key tennis markets across the globe. Direct-to-consumer gross sales will likely be supplemented

by a number of main tennis wholesalers who handle massive databases of coach, participant, faculty, highschool and membership shoppers. This market

will likely be serviced out of a third-party logistics facility in West Columbia, SC and operated by one in all Slinger’s most well-liked international

logistics companions, DSV, one of many world’s main suppliers of freight-forwarding, logistics and warehousing.

Brand

Marketing

As

a direct-to-consumer e-commerce model, all advertising exercise and promoting media will likely be centered round pushing shoppers to www.slingerbag.com

and changing them to purchases. Slinger has engaged a lot of main companies to help its international advertising efforts:

Brand

Nation is a world class influencer advertising company primarily based in London. Brand Nation will lead all influencer programming globally. Slinger

has seeded about 50% of its deliberate 1,000 international influencers up to now. Influencers focused are vast ranging and embrace main sports activities,

tennis, movie, TV, music and blogger celebrities all identified for the truth that they play tennis repeatedly and have a fan base in extra

of 10,000 followers. All influencer exercise is rolled again as much as the Slinger social media platforms as a way of producing vital

model consciousness and product curiosity.

Ad

Venture Media Group is a New York primarily based main PPC (pay-per-click) company whose work is grounded in refined scientific evaluation

of client information and client traits and they’re acknowledged globally as leaders in paid search and paid social media campaigns. Ad Venture

Media will lead all Slinger PPC exercise on a performance-based charge construction and is briefed to drive client engagement, via bespoke

promoting campaigns which can be aligned to our product profitability targets.

In

the United States market, now we have partnered with a company known as Team HQS who will handle an online marketing program throughout

USA primarily based educating professionals, gamers, juniors and occasions. These associates will likely be supplied with distinctive online marketing codes

to share with their social media followers and different such communities that they’re linked to and every will obtain an online marketing

charge primarily based on revenues generated by shoppers buying Slinger merchandise attributable to their distinctive code.

We

proceed to guage every help company on a month-to-month foundation and on the identical time are frequently exploring new avenues to develop our

attain to our core prospects.

Each

of our distributor companions world wide are establishing their Slinger distribution enterprise as Slinger itself would do if it was

establishing a Slinger subsidiary in every market. As such, every distributor may even undertake all types of Slinger model advertising packages

in addition to initiating new native ideas of their very own – all aimed toward reaching the avid/common tennis participant instantly and guaranteeing

that the Slinger model message is constant across the globe. Slinger has agreed a neighborhood advertising funds construction with every distributor

as a part of its distribution settlement. This advertising funds will likely be primarily funded by the distributor associate with a further contribution

coming from Slinger with the contribution being linked to the distributors buy targets. Each distributor will execute native grassroots

packages together with demonstration days, native educating professional partnerships, specialist tennis community communications, seeding of Slinger

product domestically as essential to native key market tennis influencers to additional enhance the depth of the influencer effort. Marketing

{dollars} may even be allotted to Google, Facebook, YouTube and different social media promoting spend and, the place applicable, authorised

and overseen by Ad Venture Media Group.

Distribution

Agreements

As

of the date of this report, Slinger Bag Americas has entered into unique distribution agreements for Slinger’s line of merchandise,

together with, however not restricted to, tennis ball launcher gadgets, tennis ball launcher equipment, sports activities baggage, tennis balls, tennis courtroom

equipment and different tennis associated merchandise within the following markets and with the next distributors:

| Territory | Distributor |

Minimum Requirement Tennis |

||

| Japan | Globeride Inc. |

32,500 via the top of January 2025 |

||

| United Kingdom and Ireland |

Framework Sports & Marketing Ltd |

9,000 via the top of May 2025 |

||

| Switzerland | Ace Distribution |

3,000 via the top of May 2025 |

||

| Denmark, Finland, Norway and Sweden |

Frihavnskompagniet ApS |

6,500 via the top of December 2025 |

||

| Morocco | Planet Sport Sarl |

1,000 via the top of December 2025 |

||

| Australia | Sportsman Warehouse t/a Tennis Only |

2,500 via the top of 2025 |

||

| New Zealand |

Sporting Goods Specialists |

100 via the top of 2025 |

||

| Bulgaria | Ark Dream EOOD |

950 via the top of 2025 |

||

| Chile | Sporting Brands Ltds |

165 via the top of 2025 |

||

| Croatia, Hungary and Slovenia |

Go 4 d.o.o. |

380 via the top of 2025 |

||

| Austria, Belgium, France, Germany, Italy, Luxembourg, Portugal, Spain and The Netherlands |

Dunlop International Europe Ltd |

120,000 via the top of 2025 |

||

| Singapore | Tennis Bot Pte Ltd |

950 via the top of 2025 |

||

| India | Racquets4U | 10,000 via the top of 2025 |

||

| Israel |

Eran |

2,050 |

||

| Bahrain, Bangladesh, Egypt, Kuwait, Maldives, Oman, Pakistan, Qatar, Saudi Arabia, Sri Lanka, Tunisia and United Arab Emirates |

Color Sports Inc |

3,000 via the top of 2025 |

||

| Greece | Elsol | 380 via the top of 2025 |

||

| Panama | Orange Pro |

50 via the top of 2021 |

||

| Russia | Neva Sport |

1,900 via the top of 2025 |

||

| Malaysia | Tennis Bot |

500 via the top of 2025 |

||

| Czech and Slovak Republics |

RaketSport s.r.o |

3,000 |

||

| South Africa |

Golf |

5,000 |

||

| Hong Kong and Macau |

Tennis |

750 |

||

| China | Xiamen Powerway Sports Co. Ltd |

17,500 via the finish of 2026 |

||

| Total | 221,175 |

Brand

Endorsements

Slinger

has reached settlement with a number of globally acknowledged model ambassadors.

Tommy

Haas (former ATP #2 Player) has been appointed the Slinger Bag Chief Ambassador. In this position Tommy will help Slinger in constructing

out its international ambassador workforce targeted on figuring out ambassadors in our key international enterprise markets of Japan, Europe, Australia, China,

Brazil and India. Tommy may even be very energetic supporting and selling Slinger throughout the globe with private appearances at Slinger

occasions and by way of on-line coaching and drill movies.

Mike

& Bob Bryan (aka the Bryan Brothers – the foremost doubles workforce within the tennis world) have prolonged their ambassador agreements

and can proceed to characteristic prominently in our advertising actions and messaging.

Eugenie

Bouchard

Jensen

Brothers

Darren

Cahill

Patrick

Mouratoglou

Dustin Brown

The

Professional Tennis Registry (PTR) – a United States-based educating affiliation with roughly 40,000 members will grow to be a

non-exclusive strategic associate for Slinger with all their members capable of entry an affiliate member a part of our web site.

Peter

Burwash International (PBI) – a United States-based, extremely revered, international tennis providers firm arrange by Peter Burwash some

35 years in the past. PBI supplies tennis packages and different tennis providers to as many as 56 of the globes main inns and resorts. Slinger

Launchers will likely be accessible to make use of at every resort and the PBI workforce will likely be actively selling Slinger as a part of our online marketing

exercise.

PTCA

Central Europe – a European Coach group of main touring professional coaches and so they, like others, will undertake an affiliate

advertising strategy.

Tie

Break 10s – a worldwide group that owns and operates Tie Break 10 occasions each independently and in partnership with main international

tour occasions, e.g., Indian Wells. These occasions contain prime gamers enjoying ‘tie-break’ matches with the occasion absolutely accomplished

in a single night and with a major money prize for the winner. Slinger will likely be promoted at every of those occasions and will likely be accessible

for followers to check out in addition to the Slinger model identify being prominently used on Tie Break 10s social media.

Tennis

One App – a United States-based firm that has developed and efficiently marketed an all-inclusive tennis app for gamers throughout

the globe. Slinger has engaged with Tennis One to help its coaches nook phase – a weekly podcast collection and in doing so

advantages from the model publicity accessible via the attain of the shoppers utilizing the app frequently.

Functional

Tennis – an Ireland primarily based social media tennis weblog web site with in extra of 250,000 followers. Slinger is engaged with Functional

Tennis in a wide range of methods and is the presenting sponsor of its weekly Tennis Podcast.

Slinger

is at present in discussions with different organizations, occasions, outstanding coaches and gamers and has up to now seeded Slinger merchandise to

12 of the highest 20 ATP male gamers, 5 of the highest 20 WTA girls gamers, plus quite a few different top-class touring and educating professionals.

Throughout

2020 Slinger sponsored a number of outstanding tennis occasions, e.g., Battle of the Brits and Tie Break 10s (all proven stay throughout the

globe).

Strategic

Brand Partnerships

Slinger

is actively engaged on securing a lot of extremely seen ground-breaking strategic partnerships throughout tennis. These partnerships will

present Slinger with co-branded merchandise to complement the core Slinger product providing and, on the identical time, are anticipated to drive

mutually useful advertising campaigns aimed toward reaching avid tennis gamers globally. Details of such companions introduced and energetic

in the present day embrace:

●

Wilson Sporting Goods: North America: Slinger has entered a strategic partnership with the worldwide chief in tennis, Wilson, for

the provision of co-branded Triniti Tennis Balls within the USA and Canada markets.

●

Professional Tennis Registry (PTR): The PTR is the world’s most prestigious educating professional group with greater than 40,000 members.

Slinger has partnered with PTR for the provision of Ball Launchers to their membership.

●

Peter Burwash International (PBI): A excessive profile group offering teaching and tennis providers to excessive stage, top quality inns,

resorts and tennis services throughout the globe. Slinger is the official provider of Ball Launchers to PBI, which will likely be used at every

location and PBI will provide an online marketing program selling gross sales to its record of worldwide shoppers.

●

DSV Logistics USA and OSL Logistics: DSV is likely one of the world’s main suppliers of warehousing, freight forwarding and logistics.

Slinger will use DSV warehousing providers within the US to optimize logistical actions. OSL are at present offering all freight forwarding

for the US markets and Europe in addition to 3rd get together warehousing logistics in Rotterdam for Europe.

Competition

There

are at present no opponents with merchandise which can be just like the Slinger Launcher, primarily based on its portability, affordability and tennis

bag performance. There are, nonetheless, different corporations that make tennis ball machines, together with the next:

| ● | Spinshot | |

| ● | Lobster Sports |

|

| ● | Spinfire Pro 2 |

|

| ● | Match Mate Rookie |

|

| ● | Sports Tutor |

|

| ● | Silent Partner |

Raw

Materials

All

supplies used within the Slinger Launcher can be found off-the-shelf. The trolley bag is manufactured with 600D Polyester and has the CA65

certification for the US market. The launcher housing, Oscillator and Ball Collector tube elements are produced utilizing an injection mould

utilizing poly propylene combined with 30% glass fibers. The digital motors, PCB boards and remote-control elements are all normal off-the-shelf

gadgets.

Intellectual

Property

As

of the date of this report, the Company has utilized for worldwide design and utility patent safety for its fundamental 3 merchandise: Slinger

Launcher, Slinger Oscillator and Slinger Telescopic Ball Tube. Patents have been utilized for in all key markets together with the US, China,

Taiwan, India, Israel and EU markets and granted in China and Israel. Trademarks have been utilized for in all main markets across the

globe Trademark safety has been utilized for and/or obtained within the following international locations:

| ● | US | |

| ● | Chile | |

| ● | Taiwan | |

| ● | Mexico | |

| ● | EU | |

| ● | Russia | |

| ● | Poland | |

| ● | Czech Republic |

|

| ● | Australia | |

| ● | New Zealand |

|

| ● | China | |

| ● | South Korea |

|

| ● | Vietnam | |

| ● | Singapore | |

| ● | India | |

| ● | Canada | |

| ● | United Arab Emirates* |

|

| ● | South Africa* |

|

| ● | Columbia* | |

| ● | Israel* | |

| ● | Japan* | |

| ● | Switzerland* | |

| ● | Indonesia* | |

| ● | Malaysia* | |

| ● | Thailand* | |

| ● | Turkey* | |

| ● | Argentina | |

| ● | Brazil |

*Protection

is pending.

Slinger

is engaged in ongoing efforts to register extra logos throughout an increasing record of merchandise, providers and purposes, that are

in varied levels of the registration course of.

Slinger

Bag Inc. owns the rights to its Slingerbag.com area.

Seasonal

Business

We

count on to expertise reasonable fluctuations in mixture gross sales quantity in the course of the 12 months. We count on revenues within the first and fourth fiscal

quarters to exceed these within the second and third fiscal quarters. However, the combination of product gross sales might range significantly from time to

time on account of modifications in seasonal and geographic demand for tennis and different sports activities gear and in reference to the timing

of serious sporting occasions, corresponding to any Grand Slam tennis match and, over time, different sports activities competitions.

Costs

and Effects of Complying with Environmental Regulations

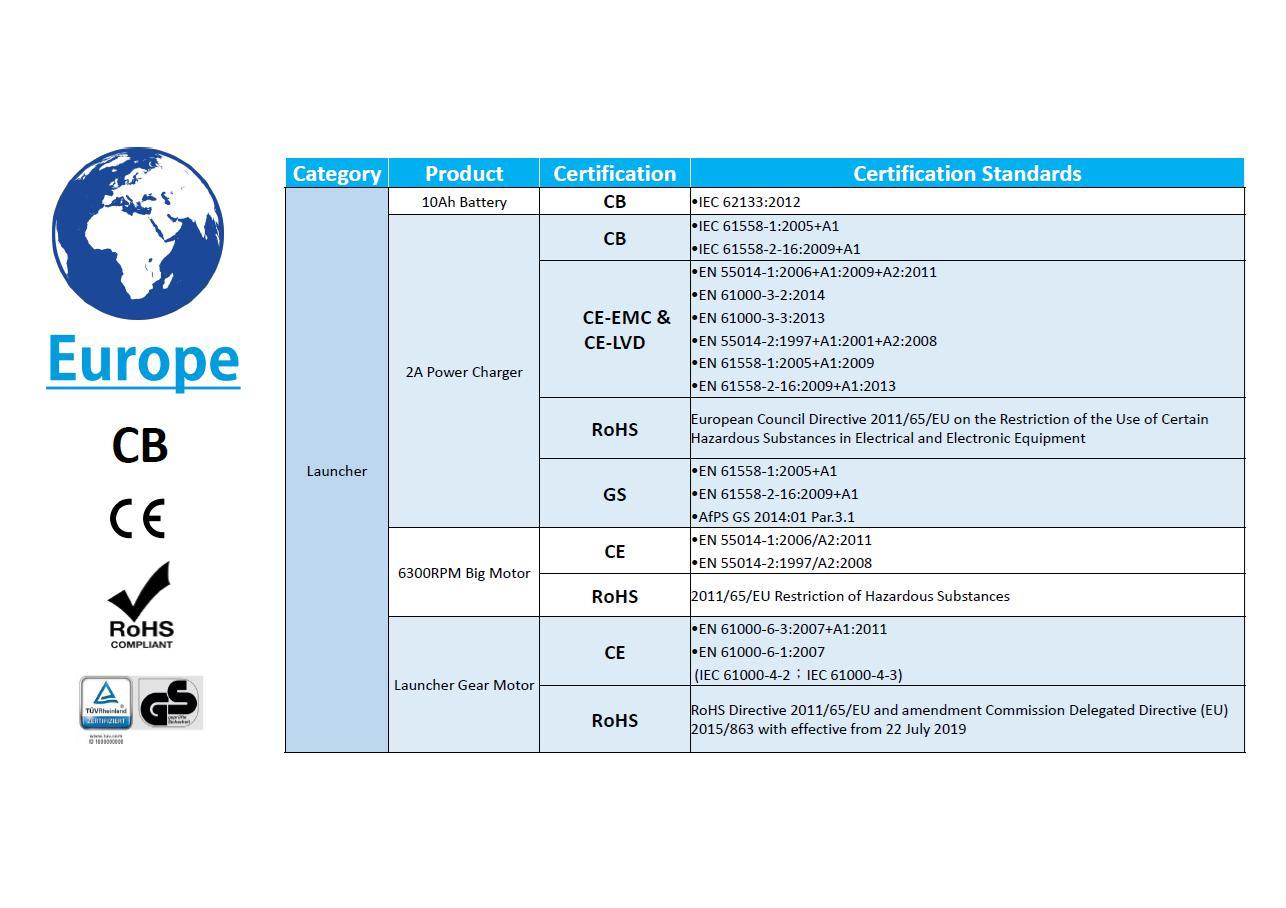

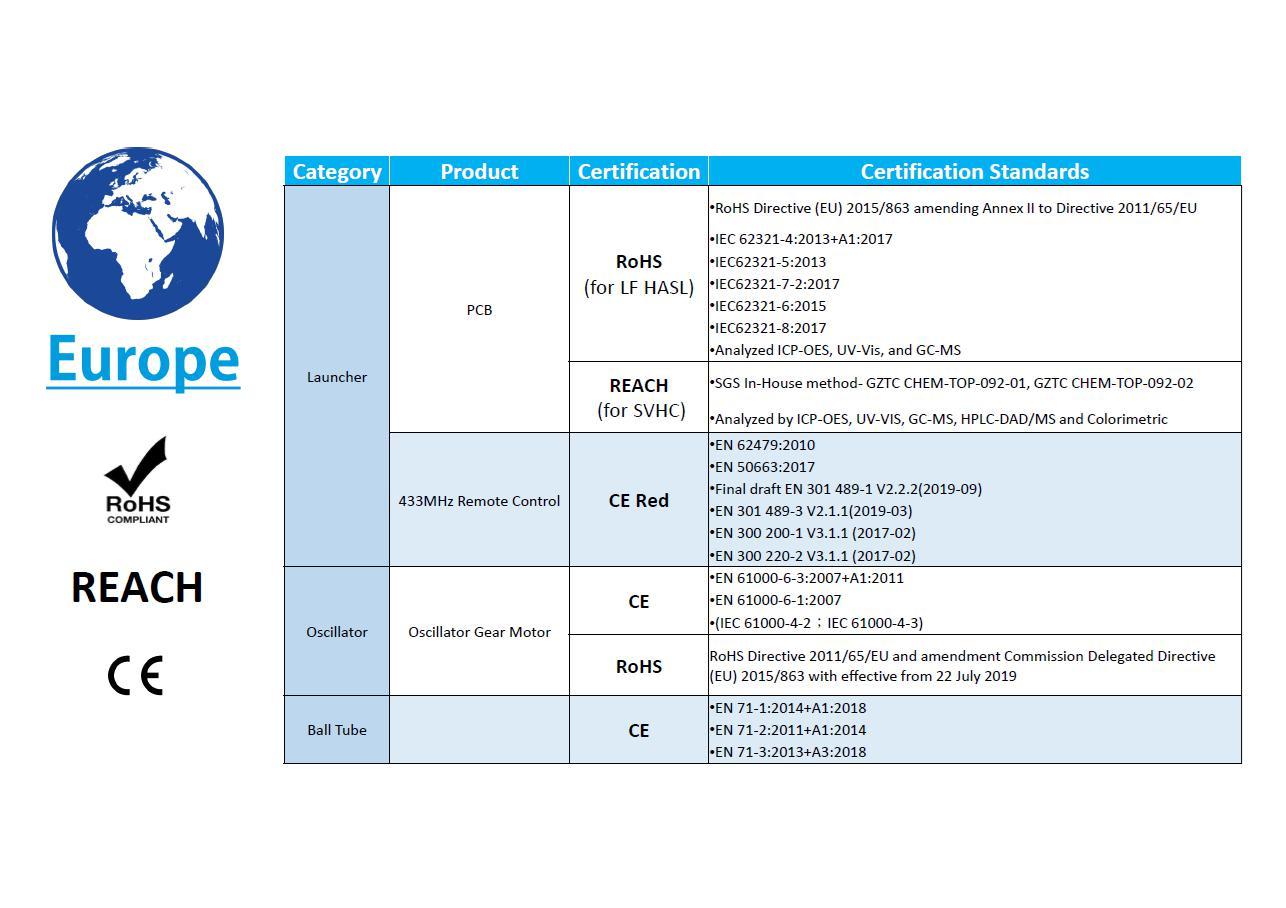

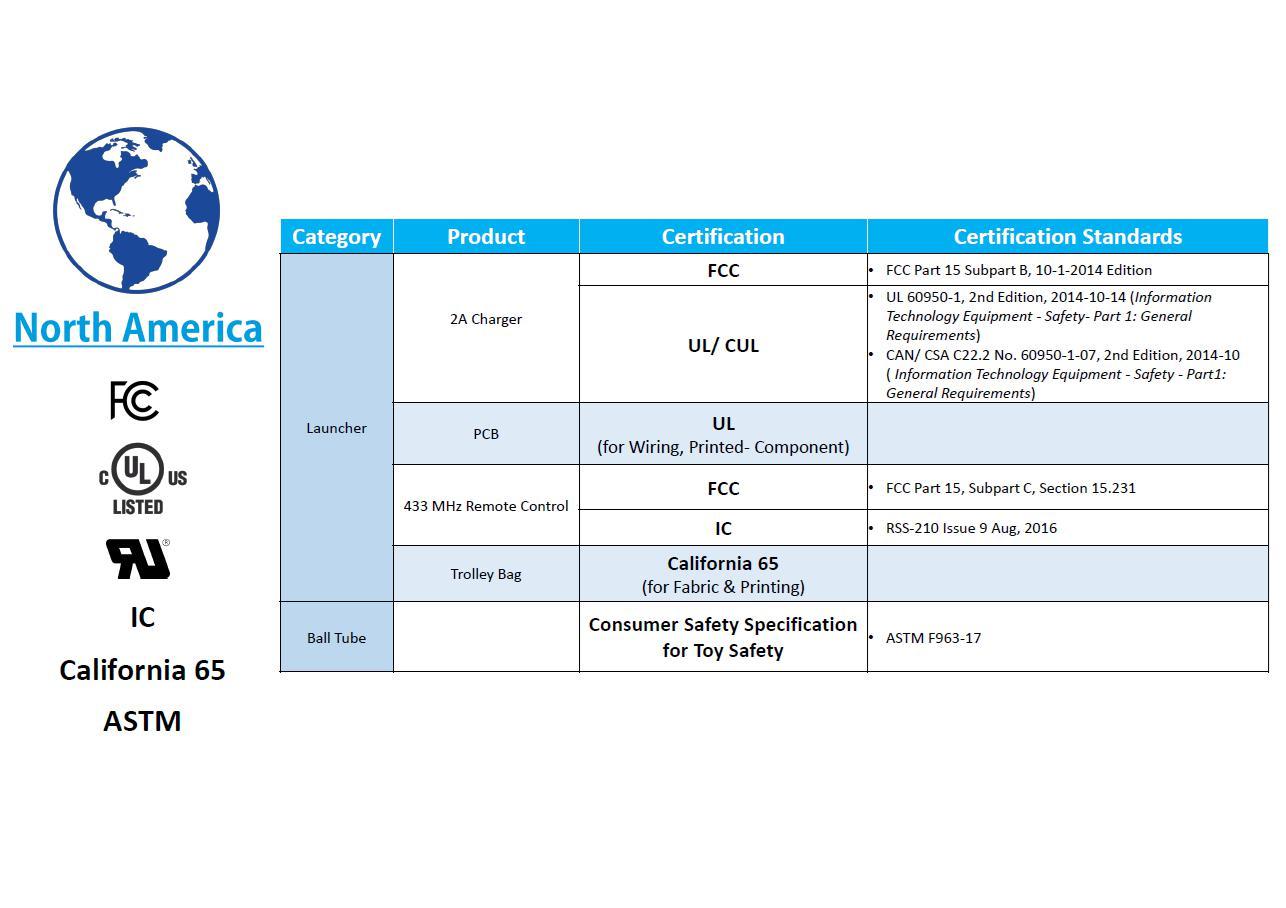

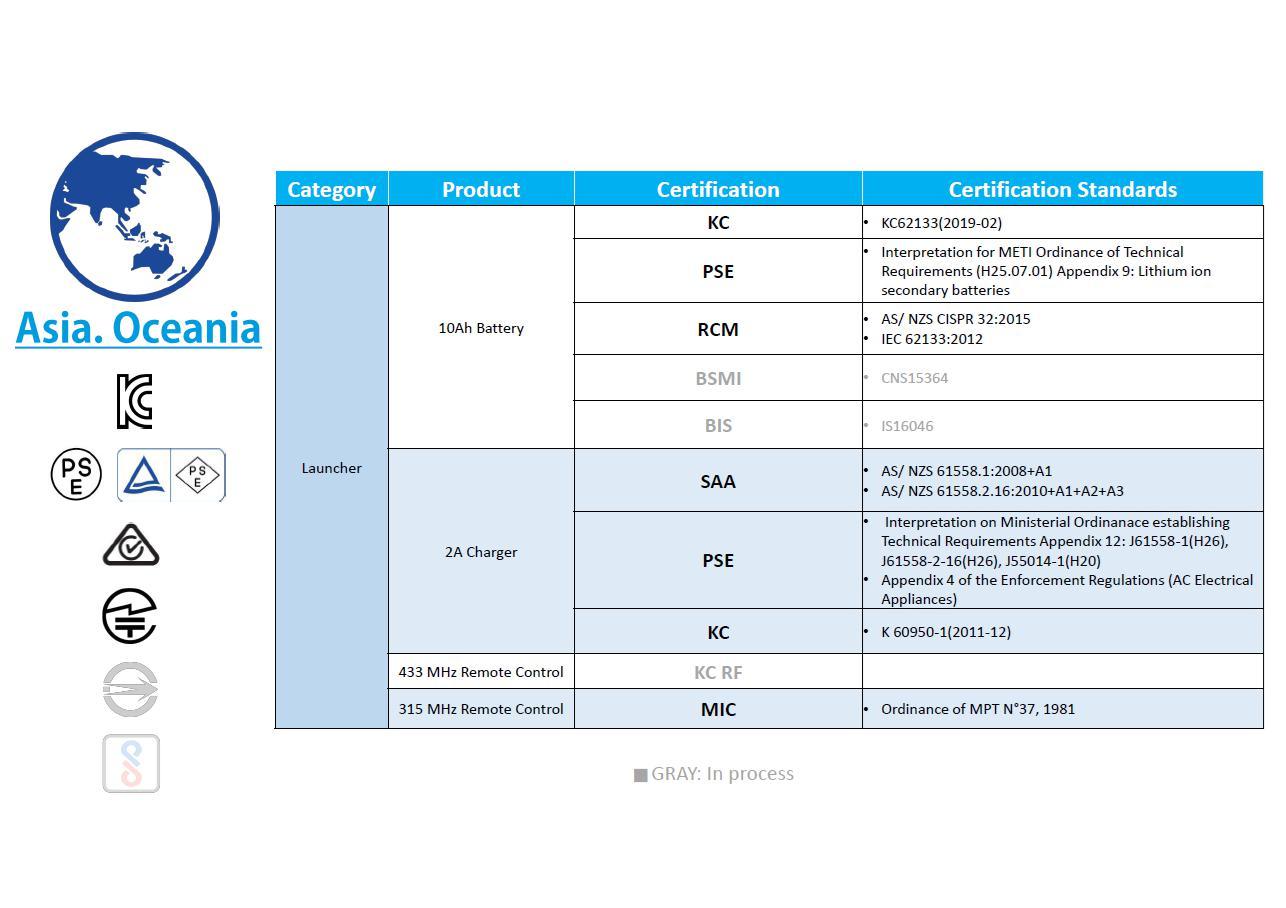

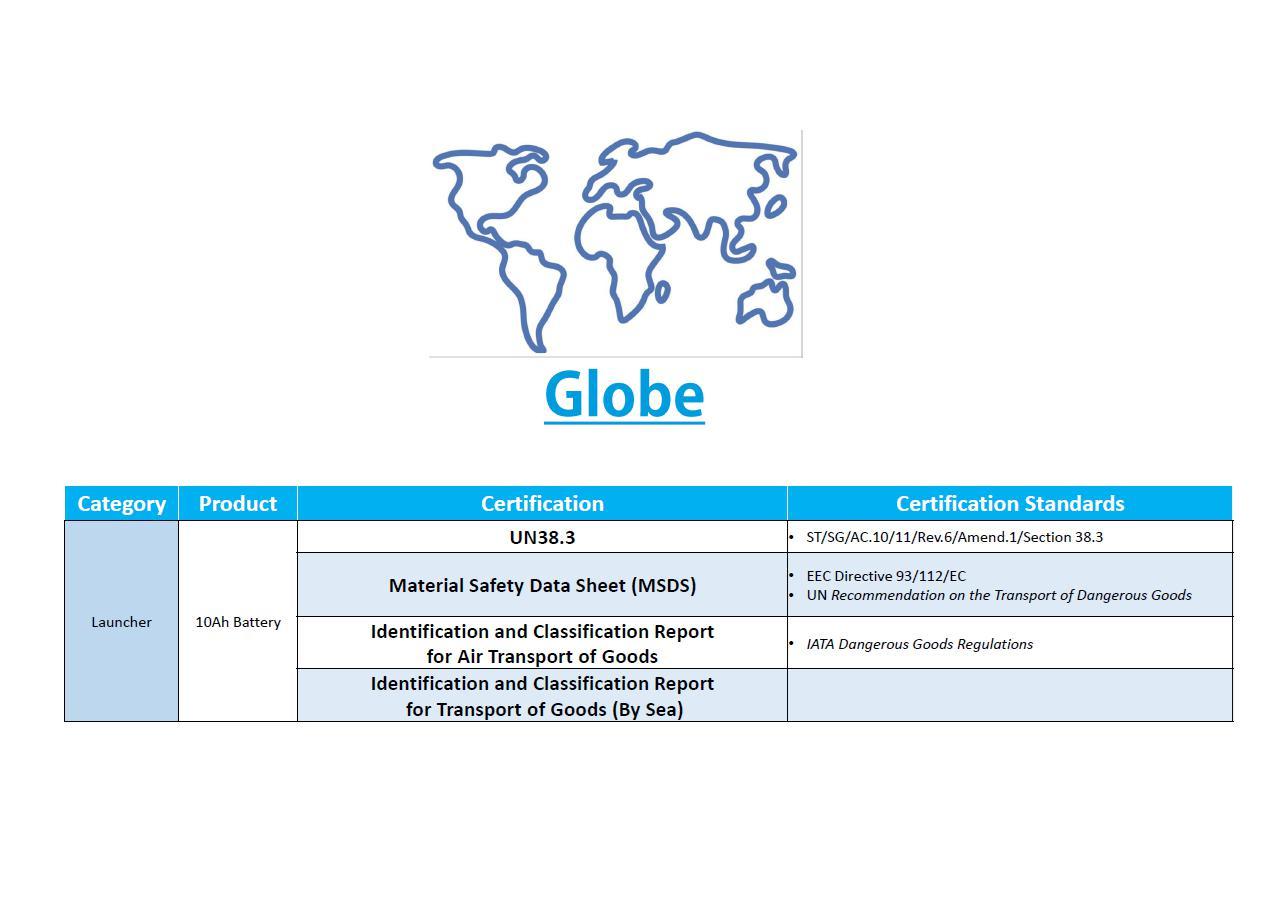

Set

forth under is an in depth chart of all Product Certifications held by Slinger for key international markets masking battery, distant management

(radio wave), and energy charger. In addition, inside the United States, Slinger complies with the required California 65 laws

in respect to the supplies used within the development of its trolley bag.

Research

and Development

The

Company is concerned in further analysis and growth of transportable, inexpensive and player-enhancing ball launching machines

and related recreation enchancment merchandise for all ball sports activities. Following a profitable launch of its tennis ball launcher, Slinger is at present

subject testing its new pickleball, padel and comfortable tennis launchers, that are anticipated to be launched to the market in calendar 2022.

Slinger plans to introduce comparable transportable, versatile and inexpensive ball launchers for baseball, softball, cricket and different

excessive participation ball sports activities over the course of the following 3 years. In this connection, on September 10, 2020, Slinger entered into an

settlement with Igloo Design, which is identical firm that designed the Slinger Launcher for tennis, for a Slinger ball launcher for

baseball and softball. This growth commenced in the course of the three months ended October 31, 2020 and preliminary design concepts and additional

path have been offered.

Slinger

retains exterior consultants to offer analysis and product design providers and every marketing consultant has a selected experience (e.g.,

molding expertise, electronics, product design, bag design as examples). We are also working with a choose group of extremely certified

and resourceful third-party suppliers in Asia. We are frequently striving to determine product enhancements, new ideas and enhancements

to the manufacturing course of on an on-going each day foundation. In respect of any new mission, administration supplies detailed briefs, market information,

product price targets, aggressive evaluation, timelines and mission price objectives to both the product consultants or distributors and manages

them to agreed key efficiency indicators (“KPIs”). These KPI’s embrace however usually are not restricted to (i) manufacturing to

goal prices; (ii) agreed growth timelines; (iii) established high quality standards; and (iv) outlined efficiency standards.

We

additionally retain specialist trademark and patent attorneys and work with

these attorneys on the initiatives, as wanted.

Government

Regulation

Both

Slinger Launcher and Slinger Oscillator meet all of the United States authorities necessities for electrical, radio wave and battery requirements

in addition to having all needed and required certification to facilitate international advertising and gross sales of those merchandise.

Quality

Control

Quality

management is a essential operate inside Slinger. As a brand new model our enterprise enterprise success will likely be solely depending on the standard

and consistency of our merchandise. To guarantee the very best ranges of high quality management, Slinger has engaged a QC/Vendor Management associate

situated in Taiwan with places of work in Southern China. The QC associate, Stride-Innovation, has over 30 years of expertise working with ball

sport corporations corresponding to ours and is steeped in data, assets and expertise in working with Chinese distributors of sports activities gear.

In

partnership, collectively, now we have created and documented Slinger high quality tips, testing procedures and guarantee processes. We have

applied an agreed Quality Audit course of for all product elements being obtained and utilized by our product meeting vendor. All merchandise

undergo a rigorous, statistically legitimate QC testing approval course of earlier than being confirmed as accessible to be launched for cargo

to one in all our distribution facilities or to any of our distribution companions.

Slinger

gives a restricted guarantee with all purchases in accordance with native market statutory laws. This restricted guarantee might be additional

prolonged by the purchaser registering his/her distinctive product serial quantity at www.slingerbag.com/guarantee.

Vendors

Slinger

solely works with and thru extremely respected third-party suppliers. We are within the strategy of finalizing vendor agreements with every of

our key vendor companions and with our vendor administration associate. Our administration and our vendor administration associate, Stride-Innovation,

repeatedly go to the seller services and monitor manufacturing, worker circumstances and welfare and undertake high quality management testing.

We don’t make the most of or condone the usage of baby labor of any variety within the manufacturing of our merchandise. We make sure that our vendor companions

are offering high quality office circumstances, office well being and security, worker care and help packages that meet or exceed all statutory

necessities.

Employees

We

have eight individuals offering us providers on a full-time foundation – our chief government officer, chief monetary officer,

controller, chief advertising officer and chief working officer along with two individuals in international customer support and a

international advertising coordinator. Our chief enterprise integration officer, chief innovation officer and basic counsel are additionally employed

pursuant to service agreements, however usually are not offering us providers on a full-time foundation. As such, our whole variety of workers is

eleven, which consists of eight full-time and three part-time workers.

Advisory

Board

In

October 2020, we appointed our first three representatives to hitch the newly fashioned Slinger Advisory Board. George Mackin joined

the advisory board as a Media and Smart expertise professional having beforehand owned the Indian Wells Tennis occasion and Tennis.com media

and is at present Chairman of PlaySight Interactive Ltd. (PlaySight) having led PlaySight to a excessive stage of success inside the international

tennis trade, Rodney Rapson joined our Advisory Board as an skilled good expertise professional and Jeff Angus joined

so as to add help and expertise to our advertising workforce.

Going

Concern

The

monetary statements have been ready on a going concern foundation, which assumes the Company will be capable of notice its property and discharge

its liabilities within the regular course of enterprise for the foreseeable future. The Company has an accrued deficit of $28,823,273

as of April 30, 2021 and extra losses are anticipated within the growth of the enterprise. Accordingly, there’s substantial doubt

in regards to the Company’s capacity to proceed as a going concern. These monetary statements don’t embrace any changes associated to

the recoverability and classification of property or the quantities and classification of liabilities that may be needed ought to the Company

be unable to proceed as a going concern.

The

capacity to proceed as a going concern depends upon the Company producing worthwhile operations sooner or later and/or having the ability

to acquire the mandatory financing to fulfill its obligations and repay its liabilities arising from regular enterprise operations once they

grow to be due. Management intends to finance working prices over the following twelve months with current money available, loans from associated

events, and/or non-public placement of debt and/or frequent inventory.

There

might be no assurance that ample funds required in the course of the subsequent 12 months or thereafter will likely be generated from operations or that funds

will likely be accessible from exterior sources corresponding to debt or fairness financings or different potential sources. The lack of further capital

ensuing from the lack to generate money move from operations or to boost capital from exterior sources would power the Company

to considerably curtail or stop operations and would, subsequently, have a fabric opposed impact on its enterprise. Furthermore, there

might be no assurance that any such required funds, if accessible, will likely be accessible on enticing phrases or that they won’t have a major

dilutive impact on the Company’s current stockholders.

The

Company intends to beat the circumstances that impression its capacity to stay a going concern via a mix of the graduation

of revenues, with interim money move deficiencies being addressed via further fairness and debt financing. The Company anticipates

elevating further funds via public or non-public financing, strategic relationships or different preparations within the close to future to help

its enterprise operations; nonetheless, the Company might not have commitments from third events for a ample quantity of further capital.

The Company can’t be sure that any such financing will likely be accessible on acceptable phrases, or in any respect, and its failure to boost capital

when wanted may restrict its capacity to proceed its operations. The Company’s capacity to acquire further funding will decide

its capacity to proceed as a going concern. Failure to safe further financing in a well timed method and on favorable phrases would have

a fabric opposed impact on the Company’s monetary efficiency, outcomes of operations and inventory worth and require it to curtail

or stop operations, dump its property, search safety from its collectors via chapter proceedings, or in any other case. Furthermore,

further fairness financing could also be dilutive to the holders of the Company’s frequent inventory, and debt financing, if accessible, might

contain restrictive covenants, and strategic relationships, if needed, to boost further funds, and should require that the Company

relinquish priceless rights.

You

ought to fastidiously contemplate the dangers described under and different info on this Annual Report on Form 10-K, together with the monetary

statements and associated notes that seem on the finish of this report, earlier than deciding to spend money on our securities. These dangers must be

thought of along with some other info included herein, together with along with forward-looking statements made herein.

If any of the next dangers truly happen, they might materially adversely have an effect on our enterprise, monetary situation and working

outcomes. Additional dangers and uncertainties that we don’t presently know or that we at present deem immaterial might also impair our enterprise,

monetary situation and working outcomes. The following dialogue of dangers just isn’t all-inclusive however is designed to focus on what

we imagine are the fabric components to think about when evaluating our enterprise and expectations. These components may trigger our future outcomes

to vary materially from our historic outcomes and from expectations mirrored in forward-looking statements.

Risks

Related to Our Business

Our

enterprise is delicate to client spending and basic financial circumstances.

Consumer

purchases of discretionary premium sporting good gadgets, which embrace all of our merchandise, could also be adversely affected by the present COVID-19

(“Coronavirus”) pandemic, in addition to financial circumstances corresponding to employment ranges, wage and wage ranges, traits in

client confidence and spending, reductions in client web price, rates of interest, inflation, the provision of client credit score and

taxation insurance policies affect on public spending confidence. Recent dramatic downturns within the power of worldwide inventory markets, currencies

and key economies have highlighted many if not all, of those dangers.

Consumer

purchases usually might decline throughout recessions, intervals of extended declines within the fairness markets or housing markets and intervals

when disposable revenue and perceptions of client wealth are decrease, and these dangers could also be exacerbated for us because of our deal with discretionary

premium sporting good gadgets. A downturn within the international economic system, or in a regional economic system by which now we have vital gross sales, may

have a fabric, opposed impact on client purchases of our merchandise, our outcomes of operations and our monetary place, and a downturn

adversely affecting our client base or vacationers may have a disproportionate impression on our enterprise.

There

continues to be a major and rising volatility and uncertainty within the international economic system as a result of Coronavirus pandemic affecting

all enterprise sectors and industries. In addition, the on-going uncertainty in Europe (together with issues that sure European international locations

might default in funds due on their nationwide debt and issues concerning the longer term viability of the European Union and the attainable

results of its unraveling) and any ensuing disruption may adversely impression our web gross sales in Europe and globally until and till

financial circumstances in that area enhance and the prospects of nationwide debt defaults in Europe decline. Further or future downturns

might adversely have an effect on site visitors at our on-line gross sales portals (which at present contains our personal web site www.slingerbag.com) and will

materially and adversely have an effect on our outcomes of operations, monetary place and progress technique.

Likewise,

the present deadlock in U.S.-China commerce relations has resulted in import duties for all Slinger merchandise into the U.S.

being elevated from the earlier normal of 5% to 30%. Our administration has taken the view that at the moment within the early years

of Slinger’s progress, gaining distribution and share outweighs the quick margin consideration and has determined to take

the added enhance in import tariffs as a margin loss.

Our

manufacturing takes place in China and, subsequently, is inclined to shutdowns and delays attributable to Coronavirus and different ailments and

epidemics. Additionally, we depend on impartial producers and suppliers.

As

on the date hereof, our sole manufacturing services are situated in southern China. Following the outbreak of the Coronavirus our manufacturing

facility was shut down for 3 months, which triggered vital delays in manufacturing and supply of our merchandise. However, there

could also be additional outbreaks of Coronavirus and different ailments and epidemics, which can trigger additional delays and shutdowns. This, in flip,

will negatively have an effect on our income and enhance our bills and prices.

We

don’t management our impartial producers and suppliers or their labor and different enterprise practices. Violations of labor, environmental

or different legal guidelines by an impartial producer or provider, or divergence of an impartial producer’s or provider’s labor

or different practices from these usually accepted as moral or applicable within the U.S., may disrupt the shipments of our merchandise or

draw destructive publicity for us, thereby diminishing the worth of our model, lowering demand for our merchandise and adversely affecting

our web revenue. Additionally, since we don’t manufacture our merchandise, we’re topic to dangers related to stock and product

quality-control.

Further,

now we have not traditionally entered into manufacturing contracts with our producers; as an alternative, now we have employed them on an advert hoc

foundation. Identifying an acceptable producer is an concerned course of that requires us to grow to be happy with the possible producer’s

high quality management, responsiveness and repair capabilities, monetary stability and labor practices. While now we have enterprise continuity

and contingency plans for various sourcing, we could also be unable, within the occasion of a major disruption in our sourcing, to find

various producers or suppliers of comparable high quality at an appropriate worth, or in any respect, which may end in product shortages

or decreases in product high quality, and adversely have an effect on our web gross sales, gross margin, web revenue, buyer relationships and our status.

We

rely upon the power of the Slinger® model.

We

count on to derive considerably all of our web gross sales from gross sales of Slinger branded merchandise. The status and integrity of the Slinger

model are important to the success of our enterprise. We imagine that our shoppers worth the standing and status of the Slinger model,

and the superior high quality, efficiency, performance and sturdiness that our model represents. Building, sustaining and enhancing the

standing and status of the Slinger model picture is essential to increasing our client base. Our continued success and progress

rely upon our capacity to guard and promote the Slinger model, which, in flip, relies on components corresponding to the standard, efficiency,

performance and sturdiness of our merchandise, our communication actions, together with promoting and public relations, and our administration

of the buyer expertise, together with direct interfaces via customer support and guarantee repairs. We might resolve to make substantial

investments in these areas with a view to keep and improve our model, and such investments might not be profitable.

Additionally,

with a view to develop our attain sooner or later, we might have to interact with third-party distributors. To the extent these third-party distributors

fail to adjust to our working tips, we might not be profitable in defending our model picture. Product defects, product recollects,

counterfeit merchandise and ineffective advertising are among the many potential threats to the power of our model and to guard our model’s

standing we might must make substantial expenditures to mitigate the impression of such threats.

Moreover,

if we fail to proceed to innovate to make sure that our merchandise are

deemed to attain superior ranges of operate, high quality and design, or to in any other case be sufficiently distinguishable from our opponents’

merchandise, or if we fail to handle the expansion of our on-line gross sales in a means that protects the high-end nature of our model, the worth

of the Slinger model could also be diluted, and we might not be capable of keep our premium place and pricing or gross sales volumes, which may

adversely have an effect on our monetary efficiency and enterprise. We imagine that sustaining and enhancing our model picture in new markets

the place now we have restricted model recognition is essential to increasing our client base. If we’re unable to keep up or improve our model

in new markets, then our progress technique may very well be adversely affected.

The

price of uncooked supplies, labor or freight may result in a rise in our price of gross sales and trigger our outcomes of operations to endure.

Increasing

prices for uncooked supplies, labor or freight may make our sourcing processes extra expensive and negatively have an effect on our gross margin and profitability.

Labor prices at our impartial producers’ websites have been growing and it’s unlikely that these will increase will abate. Wage

and worth inflation in our supply international locations may trigger unanticipated worth will increase, which can be vital. Such worth will increase

by our impartial producers may very well be fast within the absence of producing contracts. Energy prices have fluctuated dramatically

previously and should fluctuate sooner or later. Rising vitality prices might enhance our prices of transporting our merchandise for distribution

and the prices of merchandise that we supply from impartial suppliers. Further, a lot of our merchandise are product of supplies, corresponding to excessive

impression plastics, plastic-injected molded elements, and light-weight excessive tensile power metals, which can be both petroleum-based or require

vitality to assemble and transport. Costs for transportation of such supplies have been growing as the worth of petroleum will increase.

Our impartial suppliers and producers might try to cross these price will increase on to us, and {our relationships} with them could also be

harmed or misplaced if we refuse to pay such will increase, which may result in product shortages. If we pay such will increase, we might not be ready

to offset them via will increase in our pricing and different means, which may adversely have an effect on our capacity to keep up our focused gross

margins. If we try to cross the will increase on to shoppers, our gross sales could also be adversely affected.

Failure

to adequately defend our mental property and curb the sale of counterfeit merchandise may injure our model and negatively

have an effect on our gross sales.

Our

logos, copyrights, patents, designs and different mental property rights are essential to our success and our aggressive place.

We dedicate vital assets to the registration and safety of our logos and patents. In spite of our efforts, counterfeiting

and design copies should happen. If we’re unsuccessful in difficult the usurpation of those rights by third events, this

may adversely have an effect on our future gross sales, monetary situation and outcomes of operations. Our efforts to implement our mental property

rights can doubtlessly be met with defenses and counterclaims attacking the validity and enforceability of our mental property

rights. Unplanned will increase in authorized charges and different prices related to defending our mental property rights may end in

greater working bills. Additionally, authorized regimes exterior the U.S., significantly these in Asia, together with China, might not

all the time defend mental property rights to the identical diploma as U.S. legal guidelines, or the time required to implement our mental property

rights below these authorized regimes could also be prolonged and delay our restoration.

We

might grow to be topic to claims for remuneration or royalties for assigned service invention rights by our workers, which may consequence

in litigation and adversely have an effect on our enterprise.

A

good portion of our mental property has been developed by our workers, or exterior consultants in the middle of their employment

or retention with us. Under the Israeli Patent Law, 5727-1967, or the Patent Law, innovations conceived by an worker in the course of the scope

of his or her employment with an organization are considered “service innovations.” The Israeli Compensation and Royalties Committee,

or the Committee, a physique constituted below the Patent Law, has beforehand held, in sure circumstances, that workers could also be entitled to remuneration

for service innovations that they develop throughout their service for a corporation regardless of their specific waiver of such proper. Therefore, though

we enter into agreements with all of our workers pursuant to which they waive their proper to particular remuneration for service innovations

created within the scope of their employment or engagement and agree that any such innovations are owned solely by us, we might face claims

by workers demanding remuneration past their common wage and advantages.

We

face dangers related to working in worldwide markets.

We

function in a worldwide market and worldwide gross sales progress is a key factor of our progress technique. We are topic to dangers

related to our worldwide operations, together with, however not restricted to:

| ● | Foreign foreign money alternate charges, together with GBP; |

| ● | Economic or governmental instability in international markets by which we function or in these international locations from which we supply our merchandise; |

| ● | Unexpected modifications in legal guidelines, regulatory necessities, taxes or commerce legal guidelines; |

| ● | Increases in the price of transporting items globally; |

| ● | Acts of battle, terrorist assaults, outbreaks of contagious illness and different occasions over which now we have no management; and |

| ● | Changes in international or home authorized and regulatory necessities ensuing within the imposition of latest or extra onerous commerce restrictions, tariffs, duties, taxes, embargoes, alternate or different authorities controls. |

Any

of those dangers may have an opposed impression on our outcomes of operations, monetary place or progress technique. Furthermore, a few of

our worldwide operations are performed in elements of the world that have corruption to a point. Although now we have insurance policies

and procedures in place which can be designed to advertise authorized and regulatory compliance (together with with respect to the U.S. Foreign Corrupt

Practices Act and the United Kingdom Bribery Act 2010), our workers and wholesalers may take actions that violate relevant anti-corruption

legal guidelines or laws. Violations of those legal guidelines, or allegations of such violations, may have an opposed impression on our status, our

outcomes of operations or our monetary place.

Foreign

alternate actions might also negatively have an effect on the relative buying energy of international vacationers and end in declines in journey volumes

or their willingness to buy discretionary premium items, corresponding to our merchandise, whereas touring, which might adversely have an effect on our

web gross sales. We don’t at present use the spinoff markets to hedge international foreign money fluctuations.

Our

outcomes of operations are topic to seasonal and quarterly fluctuations, which may adversely have an effect on the market worth of our frequent

inventory.

Our

quarterly outcomes of operations might fluctuate considerably on account of a wide range of components, together with, however not restricted to:

| ● | Changes within the variety of our factors of distribution; |

| ● | Weather traits; |

| ● | Changes in our merchandise combine; and |

| ● | The timing of latest product introductions. |

The

progress of our enterprise relies on the profitable execution of our progress technique, together with our efforts to develop internationally by

rising our e-commerce enterprise.

Our

present progress technique relies on our capacity to proceed to develop geographically in a lot of worldwide areas together with Asia,

Europe, North America, China, Japan, South Korea, Middle East, India, South Africa and Australia. This progress technique is

contingent upon our capacity to repeatedly introduce our merchandise to new markets. The implementation of upper tariffs, quotas or different

restrictive commerce insurance policies in any worldwide areas by which we search to function may adversely have an effect on our capacity to start new

worldwide operations, which may have an opposed impression on our progress technique. Further, client demand conduct, in addition to tastes

and buying traits, might differ in varied international locations and, because of this, gross sales of our merchandise might not be, or might take time to grow to be,

profitable, and gross margins on these web gross sales might not be consistent with what we at present expertise. Our capacity to execute our worldwide

progress technique, particularly the place we’re not but established, relies on our capacity to grasp regional market demographics,

and we might not be ready to take action. If we’re unable to develop our enterprise internationally, our progress technique and our monetary

outcomes may very well be materially adversely affected.

If

we’re unable to reply successfully to modifications in market traits and client preferences, our market share, web gross sales and profitability

may very well be adversely affected.

The

success of our enterprise relies on our capacity to determine the important thing product and market traits and produce merchandise to market in a well timed

method that fulfill the present preferences of a broad vary of shoppers (both by enhancing current merchandise or by creating new

product choices). Consumer preferences differ throughout and inside completely different elements of the world, and shift over time in response to altering

aesthetics and financial circumstances. We imagine that our success in creating merchandise which can be modern and that meet our shoppers’

practical wants is a vital consider our picture as a premium model, and in our capacity to cost premium costs. We might not be ready

to anticipate or reply to modifications in client preferences, and, even when we do anticipate and reply to such modifications, we might not be

capable of carry to market in a well timed method enhanced or new merchandise that meet these altering preferences. If we fail to anticipate or

reply to modifications in client preferences or fail to carry merchandise to market in a well timed method that fulfill new preferences, our market

share and our web gross sales and profitability may very well be adversely affected.

We

could also be unable to enchantment to new shoppers whereas sustaining the loyalty of our core shoppers.

Part

of our progress technique is to introduce new shoppers, together with youthful shoppers, to the Slinger model. If we’re unable to draw

new shoppers, together with youthful shoppers, our enterprise and outcomes of operations could also be adversely affected as our core shoppers’

age will increase and ranges of journey and buying frequency lower. Initiatives and methods meant to place our model to enchantment

to new and youthful shoppers might not enchantment to our core shoppers and should diminish the enchantment of our model to our core shoppers, ensuing

in diminished core client loyalty. If we’re unable to efficiently enchantment to new and youthful shoppers whereas sustaining our model’s

premium picture with our core shoppers, then our web gross sales and our model picture could also be adversely affected.

Fluctuations

in our tax obligations and efficient tax price might have a destructive impact on our working outcomes.

We

could also be topic to revenue taxes in a number of jurisdictions. We document tax expense primarily based on our estimates of future funds, which embrace

reserves for unsure tax provisions in a number of tax jurisdictions. At anybody time, many tax years could also be topic to audit by varied

taxing jurisdictions. The outcomes of those audits and negotiations with taxing authorities might have an effect on the last word settlement of those

points. As a consequence, we count on that all year long there may very well be ongoing variability in our quarterly tax charges as occasions happen

and exposures are evaluated. Further, our efficient tax price in a given monetary interval could also be materially impacted by modifications in combine

and stage of earnings or by modifications to current accounting guidelines or laws. In addition, tax laws enacted sooner or later may

negatively impression our present or future tax construction and efficient tax charges.

Our

enterprise may endure if we’re unable to keep up our web site or handle our stock successfully.

We

make use of a distribution technique that’s closely dependent upon our web site and third-party distributors’ e-commerce web sites. The

effectiveness of our e-commerce technique relies on our capacity to handle our stock and our distribution processes successfully so

as to make sure that our merchandise can be found in ample portions and thereby forestall misplaced gross sales. If we’re not capable of keep

our e-commerce channels, or if we’re not capable of successfully handle our stock, we may expertise a decline in web gross sales, as effectively

as extra inventories for some merchandise and missed alternatives for different merchandise. In addition, the failure to ship our merchandise

to prospects in accordance with our supply schedules may injury our relationship with these prospects and result in destructive suggestions

being posted on e-commerce websites. Consequently, our web gross sales, profitability and the implementation of our progress technique may very well be adversely

affected.

We

plan to make use of money offered by working actions to fund our increasing enterprise and execute our progress technique and should require further

capital, which might not be accessible to us.

We

count on our enterprise to depend on web money offered by our future working actions as our main supply of liquidity. To help our

enterprise and execute our progress technique as deliberate, we might want to generate vital quantities of money from operations with a view to

buy stock, pay personnel, spend money on analysis and growth, and pay for the elevated prices related to working as a

public firm. If our enterprise doesn’t generate money move from working actions ample to fund these actions, and if ample

funds usually are not in any other case accessible to us, we might want to search further capital, via debt or fairness financings, to fund our progress.

Conditions within the credit score markets (corresponding to availability of finance and fluctuations in rates of interest) might make it tough for us to

receive such financing on enticing phrases and even in any respect. Additional debt financing that we might undertake, could also be costly and would possibly

impose on us covenants that limit our operations and strategic initiatives, together with limitations on our capacity to incur liens or

further debt, pay dividends, repurchase our capital inventory, make investments and have interaction in merger, consolidation and asset sale transactions.

Equity financings could also be on phrases which can be dilutive or doubtlessly dilutive to our shareholders, and the costs at which new buyers

could be keen to buy our fairness securities could also be decrease than the worth per share of our frequent inventory. The holders of latest securities

might also have rights, preferences or privileges which can be senior to these of current holders of frequent inventory. If new sources of financing

are required, however are unattractive, inadequate or unavailable, then we will likely be required to switch our progress and working plans primarily based

on accessible funding, if any, which might inhibit our progress and will hurt our enterprise.

Our

prolonged provide chain requires lengthy lead instances and depends closely on producers in Asia.

We

rely closely on producers in Asia, which requires lengthy lead instances to get items to markets. The lengthy lead instances would require

us to hold further stock to keep away from out-of-stock eventualities. In the occasion of a decline in demand for our merchandise, because of basic financial

circumstances or different components, we could also be compelled to liquidate this further stock at decrease margins or at a loss. In addition, as

a results of these lengthy lead instances, design selections are required to be made a number of months or as early as a 12 months and a half earlier than the

items are delivered. Consumers’ tastes can change between the time a product is designed and the time it takes to get to market.

If the designs usually are not common with shoppers, it may additionally end in the necessity to liquidate the inventories at decrease margins

or at a loss, which might adversely have an effect on our outcomes of operations.

We

rely upon current members of administration and key workers to implement key parts in our technique for progress, and the failure to retain

them or to draw appropriately certified new personnel may have an effect on our capacity to implement our progress technique efficiently.

The

profitable implementation of our progress technique relies upon partially on our capacity to retain our skilled administration workforce and key workers

and on our capacity to draw appropriately certified new personnel. For occasion, our chief government officer has in depth expertise

operating branded sporting items in addition to retail-oriented companies. The lack of any key member of our administration workforce or different key

workers may hinder or delay our capacity to implement our progress technique successfully. Further, if we’re unable to draw appropriately

certified new personnel as we develop over the following few years, we might not be profitable in implementing our progress technique. In both

occasion, our profitability and monetary efficiency may very well be adversely affected.

Under

relevant employment legal guidelines, we might not be capable of implement covenants to not compete.

We

usually enter into non-competition agreements as a part of our employment agreements with our workers. These agreements usually prohibit

our workers, in the event that they stop working for us, from competing instantly with us or working for our opponents or shoppers for a restricted

interval. We could also be unable to implement these agreements below the legal guidelines of the jurisdictions by which our workers work and it could be tough

for us to limit our opponents from benefitting from the experience our former workers or consultants developed whereas working for

us.

For

instance, some labor courts have required employers searching for to implement non-compete undertakings of a former worker to reveal that

the aggressive actions of the previous worker will hurt one in all a restricted variety of materials pursuits of the employer, which

have been acknowledged by the courts as justification for the enforcement of non-compete undertakings, such because the safety of an organization’s

commerce secrets and techniques or different mental property.

We

don’t make use of conventional promoting channels, and if we fail to adequately market our model via product introductions and different

technique of promotion, our enterprise may very well be adversely affected.

Our

advertising technique relies on our capacity to advertise our model’s message through the use of internet advertising and social media to advertise

new product introductions in a cheap method and presumably every now and then the usage of newspapers and magazines. We don’t make use of

conventional promoting channels corresponding to billboards, tv and radio. If our advertising efforts usually are not profitable at attracting

new shoppers and growing buying frequency by our current shoppers, there could also be no cost-effective advertising channels accessible

to us for the promotion of our model. If we enhance our spending on promoting, or provoke spending on conventional promoting, our

bills will rise, and our promoting efforts might not be profitable. In addition, if we’re unable to efficiently and cost-effectively

make use of promoting channels to advertise our model to new shoppers and new markets, our progress technique could also be adversely affected.

Failure

to guard confidential info of our shoppers and our community towards safety breaches or failure to adjust to privateness and

safety legal guidelines and laws may injury our status, model and enterprise.

A

vital problem to e-commerce and communications, together with the operation of our web site, is the safe transmission of confidential

info over public networks. Our failure to stop safety breaches may injury our status and model and considerably hurt

our enterprise and outcomes of operations. On our web site, a majority of the gross sales are billed to our shoppers’ bank card accounts

instantly, orders are shipped to a client’s handle, and shoppers go online utilizing their e-mail handle. In such transactions, sustaining

full safety for the transmission of confidential info on our web site, corresponding to shoppers’ bank card numbers and expiration